Luxury goods remain a safe bet in a stock portfolio. And the Christian Dior International holding company has undeniable advantages.

Christian Dior International is the family holding company of LVMH. Its main shareholders are the Arnault family with 97.5% held via Financière Agache. Bernard Arnault owns 0.3% and the Norwegian sovereign wealth fund 0.175%. The market capitalisation of the share is around 124 billion euros. LVMH, on the other hand, has a market capitalisation of 350 billion euros, i.e. 11.63% of the CAC 40. It is the first capitalisation of the CAC 40 ahead of Total Energies at 9.45% and the 2nd capitalisation of the EuroStoxx50.

Over the past 10 years, Christian Dior International has posted an annual stock market performance of 21.75% compared to 6.62% for the Euro Stoxx 50 and 20.32% for LVMH.

The recent decline in the Christian Dior International share price has provided an attractive entry point for investors.

In the first nine months of the year, the group achieved sales of EUR 56.5 billion, up 28% on the same period in 2021. The 2022/2021 growth rates over the 9 months are impressive: +31% for Fashion and Leather Goods, +23% for Wines and Spirits and Watches and Jewellery, +19% for Perfumes and Cosmetics…

The decline in the equity markets provides major opportunities to access the best of the market at reasonable prices. Christian Dior International clearly belongs to the class of “super growth” stocks that deliver exceptional performance.

Read also> Dior is inspired by the Baroque for its show at Paris Fashion Week

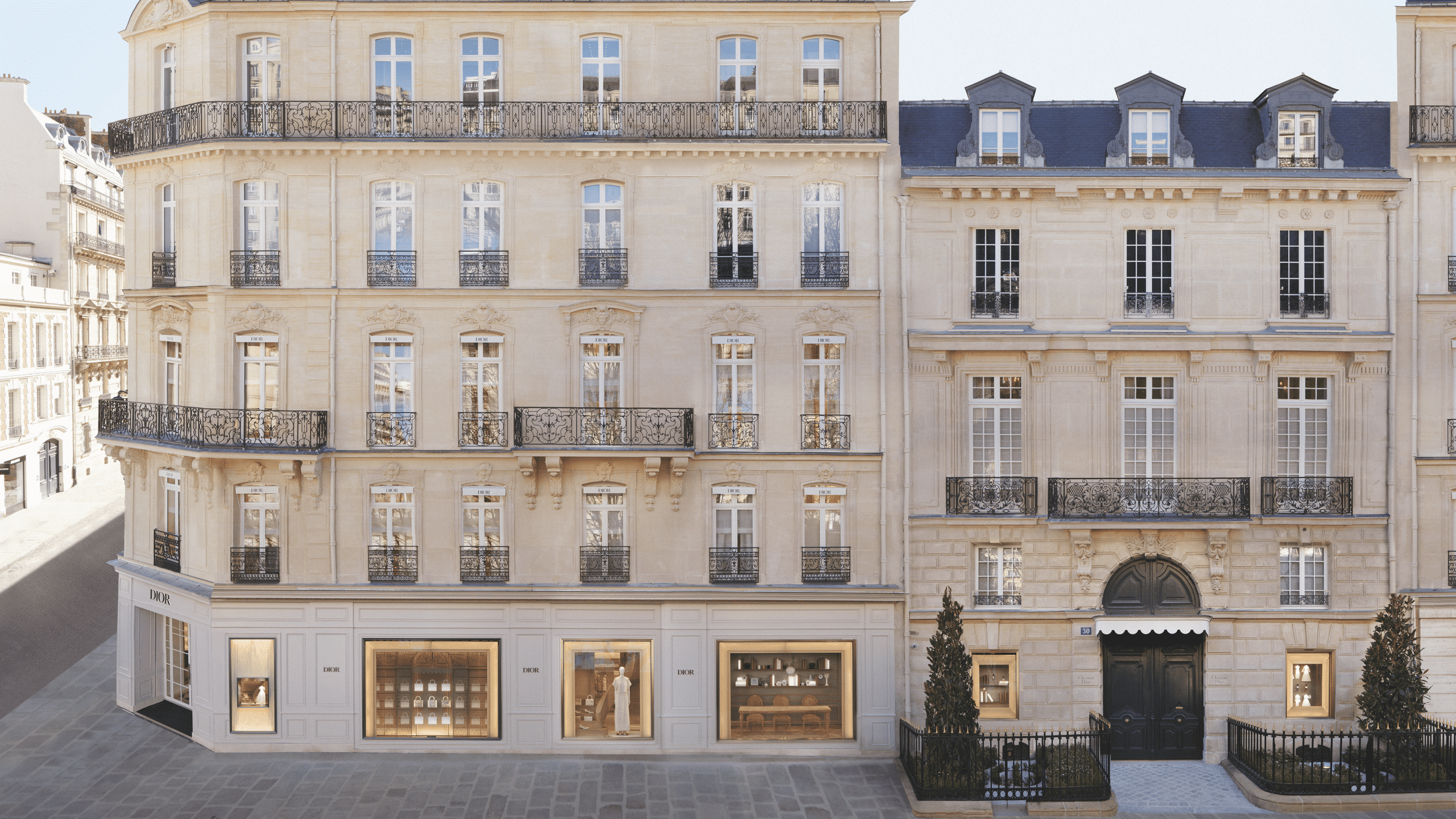

Featured photo : © Kevin Hellon / Shutterstock.com