[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

The Frasers Group, led by Mike Ashley, acquired a 5.1% stake in Hugo Boss through equities and derivatives.

The group claims to have purchased 120,000 shares of Hugo Boss common stock, 140,000 shares of common stock through contracts for the difference, and 3.29 million shares of common stock through the sale of put options.

“Frasers Group intends to be a supportive stakeholder and to create value for the benefit of Frasers Group shareholders and Hugo Boss,” Mike Ashley said last Friday.

With this acquisition, the British sports group is continuing its move upmarket. The operation is part of its ambition to create the “Harrods of the Street”.

In August 2018 the group acquired House of Fraser as part of a £90 million administrative agreement to roll out its new luxury oriented Frasers concept.

After taking into account the premium it would receive under the put options, Frasers Group stated that its maximum aggregate exposure in relation to its acquired interest in Hugo Boss is approximately £97 million.

At the beginning of the year, Frasers Group had already acquired a 12.5% interest in the luxury accessories retailer Mulberry.

Read also > HUGO BOSS EXCEEDS EXPECTATIONS ON FIRST QUARTER

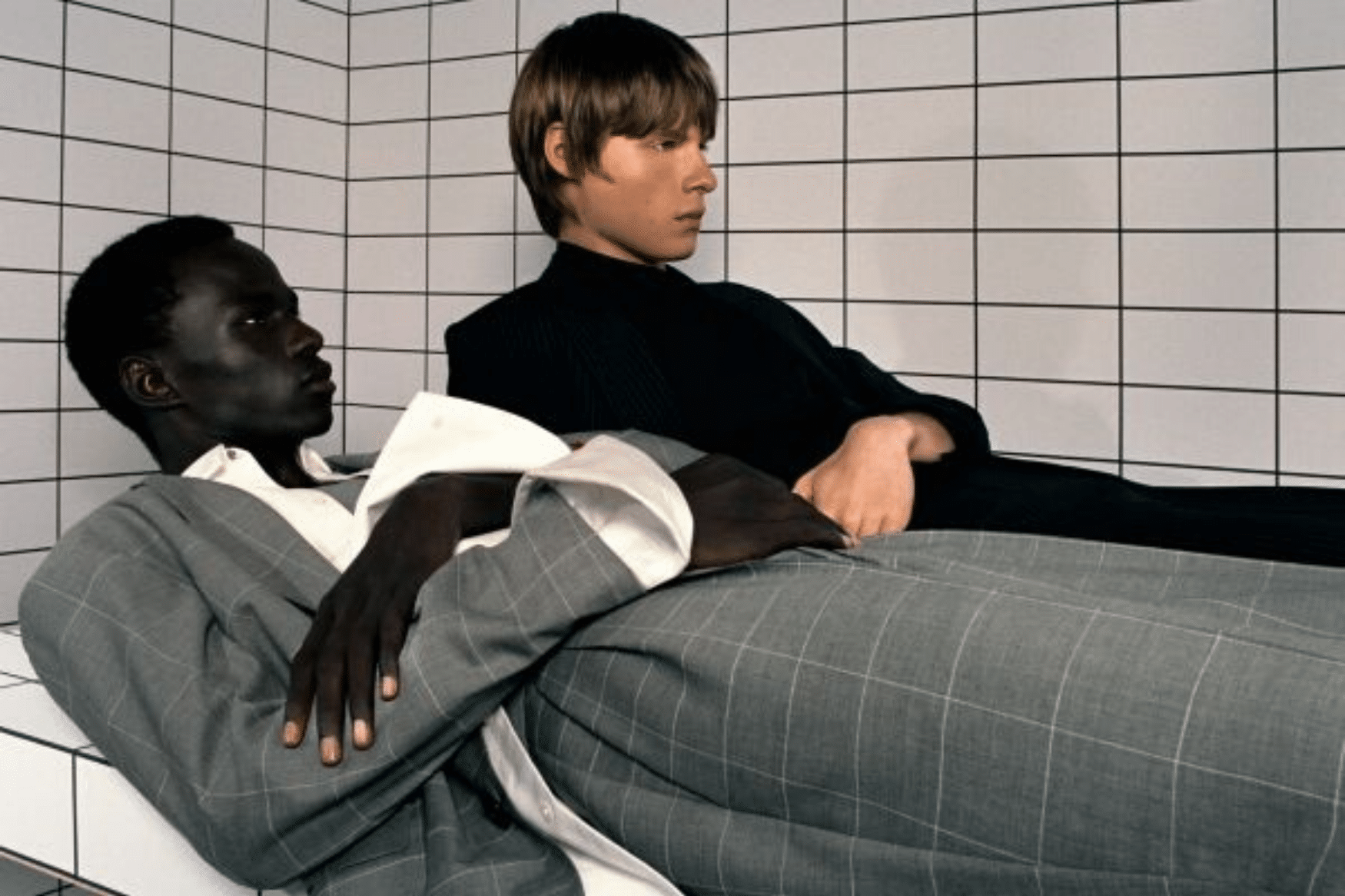

Featured photo : © Hugo Boss[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

The Frasers Group, led by Mike Ashley, acquired a 5.1% stake in Hugo Boss through equities and derivatives.

The group claims to have purchased 120,000 shares of Hugo Boss common stock, 140,000 shares of common stock through contracts for the difference, and 3.29 million shares of common stock through the sale of put options. […][/vc_column_text][vc_cta h2=”This article is for subscribers only.” h2_font_container=”font_size:16″ h2_use_theme_fonts=”yes” h4=”Subscribe now!” h4_font_container=”font_size:32|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE!” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fabonnements-et-newsletter-2%2F|||”]Unlimited access to all the articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account? Log in.

[/vc_cta][vc_column_text]Featured photo : © Hugo Boss[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”customer”][vc_column][vc_column_text]

The Frasers Group, led by Mike Ashley, acquired a 5.1% stake in Hugo Boss through equities and derivatives.

The group claims to have purchased 120,000 shares of Hugo Boss common stock, 140,000 shares of common stock through contracts for the difference, and 3.29 million shares of common stock through the sale of put options. […][/vc_column_text][vc_cta h2=”This article is for subscribers only.” h2_font_container=”font_size:16″ h2_use_theme_fonts=”yes” h4=”Subscribe now!” h4_font_container=”font_size:32|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE!” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fabonnements-et-newsletter-2%2F|||”]Unlimited access to all the articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account? Log in.

[/vc_cta][vc_column_text]Featured photo : © Hugo Boss[/vc_column_text][/vc_column][/vc_row]