[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

The French luxury goods group Hermès surpassed €200 billion in market value on the CAC 40 for the first time this week. With its high valuation, the group seems more prepared for the risks of recession that are hanging over the Western economies. Even if the evolution of its share price remains to be watched…

Hermès may be the best student in the luxury sector right now. The French luxury giant surpassed 200 billion euros in market value for the first time this week on the CAC 40. Its stock rose to nearly €1.919, up from less than €958 at the end of June 2022, a twofold increase in its share price over the period!

In the luxury sector, it is outpaced by the world leader LVMH, which reigns supreme with a value of 420 billion euros. This week, the fortune of its majority shareholder, Bernard Arnault (now the world’s largest fortune according to the Forbes ranking), exceeded 200 billion euros.

By 2023, Hermès International had grown by about 30% and is now worth more than the combined value of a series of French companies in several sectors, including Airbus, Renault, Vivendi and Orange.

The recovery of the Chinese economy is a key factor in this valuation, as the luxury sector has benefited from strong demand in that market since January. The group also benefits from significant pricing power, the ability of a company to set its prices, allowing it to increase sales prices in recent months. At the end of 2022, Hermès had announced strong price increases, in the order of 8 to 10%, compared to 2 to 4% in previous years, emphasized the management company Amplegest last January, interviewed by Capital.

Prepared for the risks

While investors remain concerned about the current economic situation, Hermès seems to be perfectly resilient to the inflationary environment. And the group should weather the risk of recession that analysts are predicting relatively well.

“While Hermès is unlikely to be immune to the risk of a slowdown in global trends due to an increasingly complex macroeconomic environment, we expect its unique supply-driven business model to drive this continued outperformance”, UBS Group analysts noted in an April 4 note.

Meanwhile, analysts are busy raising their price targets for Hermès ahead of its first-quarter earnings release on April 14.

Towards a slowdown?

Despite its impressive valuation and strong share price, Hermès may still seem expensive on the stock market. Moreover, according to the financial group Oddo, the pace of growth in the luxury goods sector is likely to slow down in the second half of the year.

It is also worth noting that when Hermès peaked on Wednesday, the stock was “overbought” (which means that its upside potential was exhausted and that the probability of a reversal is high).

Hermès was not the only one to benefit from the boom in luxury stocks, as Burberry and Hugo Boss also benefited. This year, the rise in luxury stocks has made Paris the leading stock market in Europe, overtaking London.

Read also >Hermès made it big in 2022

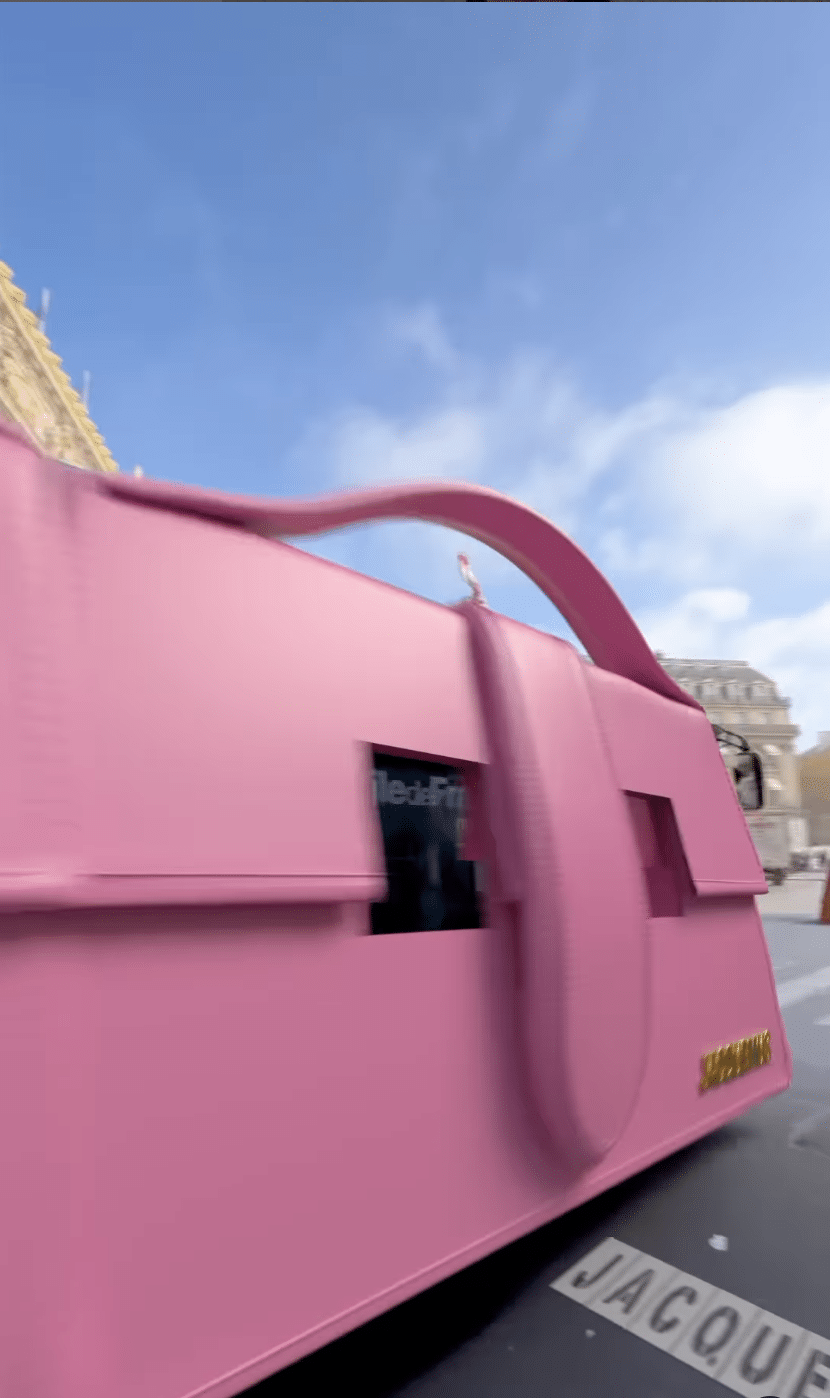

Featured photo : ©Hermès[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

The French luxury goods group Hermès surpassed €200 billion in market value on the CAC 40 for the first time this week. With its high valuation, the group seems more prepared for the risks of recession that are hanging over the Western economies. Even if the evolution of its share price remains to be watched…

Hermès may be the best student in the luxury sector right now. The French luxury giant surpassed 200 billion euros in market value for the first time this week on the CAC 40. Its stock rose to nearly €1.919, up from less than €958 at the end of June 2022, a twofold increase in its share price over the period!

In the luxury sector, it is outpaced by the world leader LVMH, which reigns supreme with a value of 420 billion euros. This week, the fortune of its majority shareholder, Bernard Arnault (now the world’s largest fortune according to the Forbes ranking), exceeded 200 billion euros.

By 2023, Hermès International had grown by about 30% and is now worth more than the combined value of a series of French companies in several sectors, including Airbus, Renault, Vivendi and Orange.

The recovery of the Chinese economy is a key factor in this valuation, as the luxury sector has benefited from strong demand in that market since January. The group also benefits from significant pricing power, the ability of a company to set its prices, allowing it to increase sales prices in recent months. At the end of 2022, Hermès had announced strong price increases, in the order of 8 to 10%, compared to 2 to 4% in previous years, emphasized the management company Amplegest last January, interviewed by Capital.

Prepared for the risks

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © Hermès[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

The French luxury goods group Hermès surpassed €200 billion in market value on the CAC 40 for the first time this week. With its high valuation, the group seems more prepared for the risks of recession that are hanging over the Western economies. Even if the evolution of its share price remains to be watched…

Hermès may be the best student in the luxury sector right now. The French luxury giant surpassed 200 billion euros in market value for the first time this week on the CAC 40. Its stock rose to nearly €1.919, up from less than €958 at the end of June 2022, a twofold increase in its share price over the period!

In the luxury sector, it is outpaced by the world leader LVMH, which reigns supreme with a value of 420 billion euros. This week, the fortune of its majority shareholder, Bernard Arnault (now the world’s largest fortune according to the Forbes ranking), exceeded 200 billion euros.

By 2023, Hermès International had grown by about 30% and is now worth more than the combined value of a series of French companies in several sectors, including Airbus, Renault, Vivendi and Orange.

The recovery of the Chinese economy is a key factor in this valuation, as the luxury sector has benefited from strong demand in that market since January. The group also benefits from significant pricing power, the ability of a company to set its prices, allowing it to increase sales prices in recent months. At the end of 2022, Hermès had announced strong price increases, in the order of 8 to 10%, compared to 2 to 4% in previous years, emphasized the management company Amplegest last January, interviewed by Capital.

Prepared for the risks

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © Hermès[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]