[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

The Watches & Wonders exhibition returns this year from March 27 to April 2 in Geneva and Luxus+, partner of the event, is keeping you waiting with a special series in advance of the event… Reports, encounters, favorites, practical information and gift ideas are to be discovered now while waiting to meet you in Geneva for the preview launch of our special watchmaking issue!

Tiffany & Co. recently appealed to the younger generation by featuring the iconic couple Jay-Z and Beyoncé in its latest campaign. For the House of Fine Jewelry, it’s about expanding its target audience via the generation Z through artists and celebrities who speak to them.

Is Generation Z really a consumer of fine jewelry? 91% of this age group believes that companies should only make a profit if they have a positive impact on society. Today it is interesting to know if this generation consumes fine jewelry.

How can brands integrate the Gen Z’s thoughts and aspirations into the transition of their Houses?

The report of young French consumers to online luxury shows a growing expectation in terms of purchasing and payment flexibility. Split or staggered payments, virtual fitting, video presentations, etc.

Conducted among a thousand luxury consumers by Dynata, the survey concerns luxury or premium items sold at more than 500 euros for fashion, 300 euros for beauty, and 1,000 euros for jewelry and decoration. And all within the data of Klarna, which specializes in fractional payments. Within this perimeter, 45% of the observed luxury buyers would have purchased a luxury product (including premium) in 2021. And the share rises to 63% among Millennials and Gen Z, against 45% for Gen X and 25% for Baby Boomers. Fashion is the second most popular product (41%), behind watches/jewellery (51%) and beauty (32%).

On the other hand, there is a strong disparity in the role of social networks according to the generation. No less than 75% of Gen Z have already bought a luxury product seen on social networks, and 63% of Millennials, compared to 37% for Gen X and 18% for Baby Boomers.

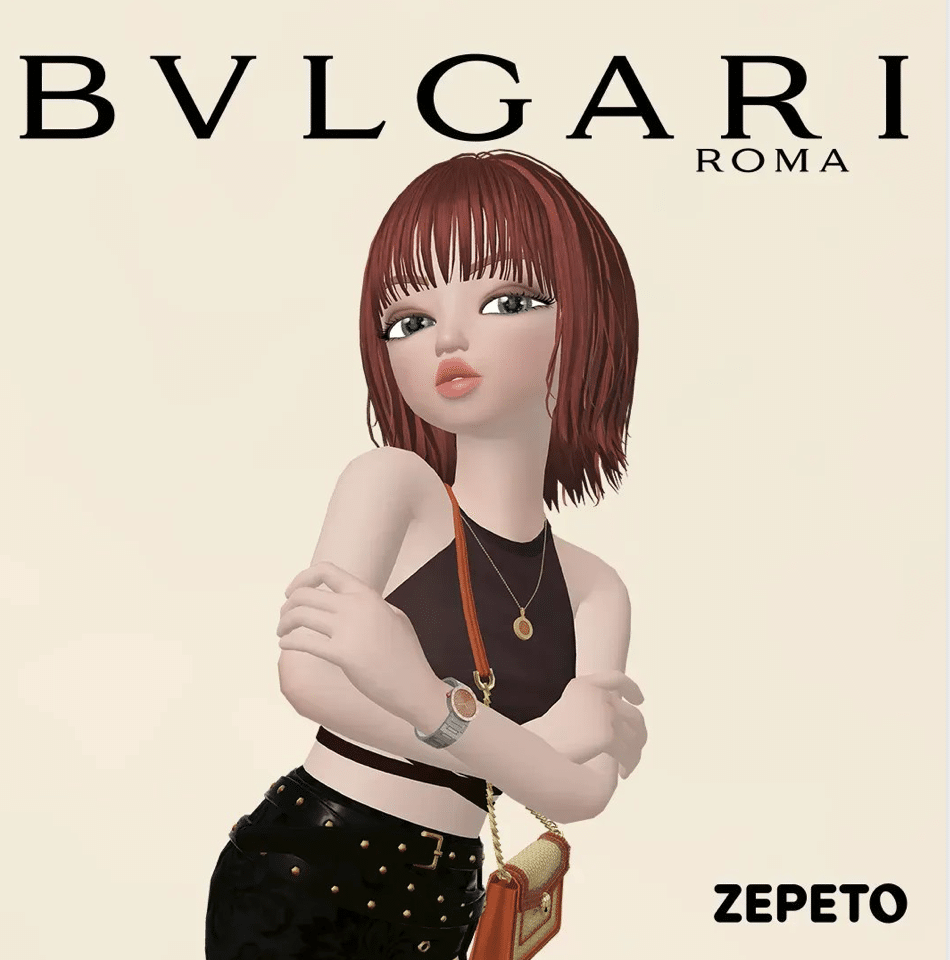

Bulgari and Tiffany&Co are trying to seduce Gen Z. with their strategic choice on Zendaya and Anne Hatteway for their latest digital campaign. Zendaya is an icon for the Gen Z whereas Anne Hatteway is an icon for the Millennials. They represent their followers who now represent the biggest part of the fine/high jewelry consumers, and Gen Z, who represent the future biggest customers in the industry.

It is not the only attempt of Bulgari to get closer to Gen Z. In fact, Bulgari has opened an exclusive virtual world on Asia’s biggest metaverse platform, Zepeto. It includes a pop-up store, Bulgari Sunset In Jeju, and provides visitors with online and offline experiences. Why is this an interesting thing to do for the brand? Because Zepeto is used by 320 millions of people through the world, 80% of these users being teenagers, members of the Gen Z. It may seem useless because teenagers are not Bulgari’s target, however they are the future customers of the brand.

Tiffany & Co., which is one of the world’s leading luxury jewelers, has introduced new products and increased its online presence to attract millennial and Generation Z buyers. The brand’s marketers have changed the “perceived historical brand message” to suit millennials, for example by leveraging luxury e-commerce startups to target affluent millennials in 40 countries. However, the challenge with this strategy is that it relies heavily on brand marketing, advertising and leveraging their diamonds as branded designer pieces to sell products. Influencer marketing and advertising are the main tools to capture the attention of these generations’ consumers. Millennials and Generation Z are looking more to new and other brands to find good quality, with more affordable pieces that also satisfy their need to connect more with the brands they buy.

Moreover, Tiffany&Co recently launched their latest digital campaign futuring Ninon Rambaud and her mother, Nathalie Olivier. They became famous on Tiktok with videos that became popular pretty quickly among Millenials and Gen Z. They were chosen by the brand for the promotion of the Tiffany Lock collection focused on bracelets and pendants that look like locks. The campaign features Ninon and her mother Nathalie and is displayed on social media, especially TikTok and Instagram, the social media on which Millenials and Gen Z are the most present and active.

View this post on Instagram

We can clearly see with these two brands that this sector is trying to get closer to the Millenials and the Gen Z as their upcoming customers in the future. According to Tiffany’s press officer, Gen Z may represent the future customer of fine jewelry in the years to come: “A brand that a young person has followed throughout his or her youth will continue to consume the same House later on for fine jewelry. In fact, this is what the House has been trying to establish for years. We offer the first “Return to Tiffany” necklace to the 16 year old girl, then the T bracelet for the 25 year old woman, and the 30, 40 year old… offers the diamonds afterwards“.

Brands’ are being more and more active and present on social media, sometimes working more with influencers than celebrities, adopting Gen Z codes. This is an attempt to seduce the future generation of customers.

Indeed, to please this generation, it is necessary to create a story around the brand and the jewelry in line with their values (social justice, environment…), to be more aesthetic, more technology-based and unique. Moreover, brands should not neglect social networks, the primary source of information for members of this generation.

Thus, there is a particular disconnect between some traditional brands and the new generation who are struggling to keep up with the times and change their strategies to appeal to these new buyers. Moreover, with the arrival of new brands on the market that speak more to Generation Z, the long-term risk is that they will see their sales decrease if they do not make the necessary changes to remain relevant.

Read also > Venezia 1920, the natural cosmetics brand that wants to seduce Gen Z

Featured photo : © T&CO. 2023 [/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

The Watches & Wonders exhibition returns this year from March 27 to April 2 in Geneva and Luxus+, partner of the event, is keeping you waiting with a special series in advance of the event… Reports, encounters, favorites, practical information and gift ideas are to be discovered now while waiting to meet you in Geneva for the preview launch of our special watchmaking issue!

Tiffany & Co. recently appealed to the younger generation by featuring the iconic couple Jay-Z and Beyoncé in its latest campaign. For the House of Fine Jewelry, it’s about expanding its target audience via the generation Z through artists and celebrities who speak to them.

Is Generation Z really a consumer of fine jewelry? 91% of this age group believes that companies should only make a profit if they have a positive impact on society. Today it is interesting to know if this generation consumes fine jewelry.

How can brands integrate the Gen Z’s thoughts and aspirations into the transition of their Houses?

The report of young French consumers to online luxury shows a growing expectation in terms of purchasing and payment flexibility. Split or staggered payments, virtual fitting, video presentations, etc.

Conducted among a thousand luxury consumers by Dynata, the survey concerns luxury or premium items sold at more than 500 euros for fashion, 300 euros for beauty, and 1,000 euros for jewelry and decoration. And all within the data of Klarna, which specializes in fractional payments. Within this perimeter, 45% of the observed luxury buyers would have purchased a luxury product (including premium) in 2021. And the share rises to 63% among Millennials and Gen Z, against 45% for Gen X and 25% for Baby Boomers. Fashion is the second most popular product (41%), behind watches/jewellery (51%) and beauty (32%).

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © extract from the Audemars Piguet video[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

The Watches & Wonders exhibition returns this year from March 27 to April 2 in Geneva and Luxus+, partner of the event, is keeping you waiting with a special series in advance of the event… Reports, encounters, favorites, practical information and gift ideas are to be discovered now while waiting to meet you in Geneva for the preview launch of our special watchmaking issue!

Tiffany & Co. recently appealed to the younger generation by featuring the iconic couple Jay-Z and Beyoncé in its latest campaign. For the House of Fine Jewelry, it’s about expanding its target audience via the generation Z through artists and celebrities who speak to them.

Is Generation Z really a consumer of fine jewelry? 91% of this age group believes that companies should only make a profit if they have a positive impact on society. Today it is interesting to know if this generation consumes fine jewelry.

How can brands integrate the Gen Z’s thoughts and aspirations into the transition of their Houses?

The report of young French consumers to online luxury shows a growing expectation in terms of purchasing and payment flexibility. Split or staggered payments, virtual fitting, video presentations, etc.

Conducted among a thousand luxury consumers by Dynata, the survey concerns luxury or premium items sold at more than 500 euros for fashion, 300 euros for beauty, and 1,000 euros for jewelry and decoration. And all within the data of Klarna, which specializes in fractional payments. Within this perimeter, 45% of the observed luxury buyers would have purchased a luxury product (including premium) in 2021. And the share rises to 63% among Millennials and Gen Z, against 45% for Gen X and 25% for Baby Boomers. Fashion is the second most popular product (41%), behind watches/jewellery (51%) and beauty (32%).

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © extract from the Audemars Piguet video[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]