[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

As a gateway to the brand universe for an aspirational, less affluent clientele, perfume has served as a geographic gas pedal and anti-crisis remedy for luxury companies. While uncertainty is gaining ground, the potential of the Chinese market is giving new importance to this market, to the point that many players want to challenge L’Oréal on its own ground.

The insolent health of Beauty

Although once shaken by Covid, Beauty is now experiencing a rebound in sales, to the point that the major luxury groups are intensifying their diversification and multiplying their investments.

Judging by the number of mergers, acquisitions, and operations in this sector, it has become dynamic and ultra-competitive. L’Oréal, which missed out on the purchase of Byredo in favor of the Spanish group Puig, has just acquired Aesop – the Brazilian group Natura & Co’s nugget valued at 2 billion dollars – under the nose of LVMH and Shiseido. For its part, Estée Lauder has just acquired Tom Ford Beauty and will take over the development of Balmain Beauty. The Coty group has also sold its Lacoste license to Interparfums.

The economic performance of the Beauty category partly explains this renewed interest in the sector, as well as the deteriorated economic context, which forces occasional luxury consumers to make new choices.

L’Oréal, the historic specialist in Beauty, has thus positioned itself particularly well, demonstrating the strategic nature of this accessible luxury product. The L’Oréal luxury division has been THE division of all achievements for the past two years. With 14.6 billion euros in 2022, it has the best sales of the group, an increase of 18.6% as reported, where the growth of the L’Oréal group is only 10.9% on a comparable basis, at 38.26 billion euros. But nothing is more desirable than its operating margin of 22.9% compared with 19.8% for its “consumer” products.

On the top step of the podium of generalist luxury groups, LVMH has seen its sales of beauty products and cosmetics jump by 17% on a comparable basis to 7.7 billion euros in 2022. This division of perfumes and cosmetics includes about fifteen companies (Parfums Christian Dior, Guerlain, Maison Francis Kurkdjian, and Kendo…) would represent 10% of the group’s revenues and 3% of its profits, according to the firm Bernstein. Its 2022 fiscal year was also driven by its selective distribution division through the giant Sephora. The latter demonstrates the power of geographic expansion of beauty products. After 18 years of absence from the UK, the beauty retailer has just opened its first outlet in London. Strengthening its partnership initiated in 2021 with the American department store chain Kohl’s, it has set foot in seven new American states with the opening of 250 new sales spaces. Dubbed Sephora at Kohl’s, these 850 spaces replace the U.S. retailer’s beauty assortment as a “stores within a store” concept.

Among the emblematic luxury groups – but not specialists in Beauty – is the House of Hermès. Its Beauty business (excluding Perfume) represents only 4% of its sales, but the group does not intend to stop there. After making its first foray in 2020 with a collection of lipsticks, followed by nail polish and blushes two years later, the Maison du Faubourg Saint Honoré is preparing the launch of eye products by 2024.

For its part, the Kering group unveiled the launch of its Kering Beauté division in February. Like other groups, it is taking the opportunity to strengthen its top management in this segment via talent from major groups. It has thus appointed Raffaella Cornaggia, a former executive at Estée Lauder, as its new head. She is in charge of piloting the development of the Bottega Veneta, Alexander McQueen, Balenciaga, Qeelin, and Pomellato brands in the Beauty segment, which until now have been licensed to the Coty group.

Wishing to reorganize the group by business, LVMH has announced new appointments at the head of its Beauty division. Bernard Arnault has entrusted the management of this highly strategic division to Stéphane Rinderknech, a l’oréalien who has worked in the Chinese and American markets for nearly twenty years.

Read also > L’Oréal acquires Australian brand Aesop

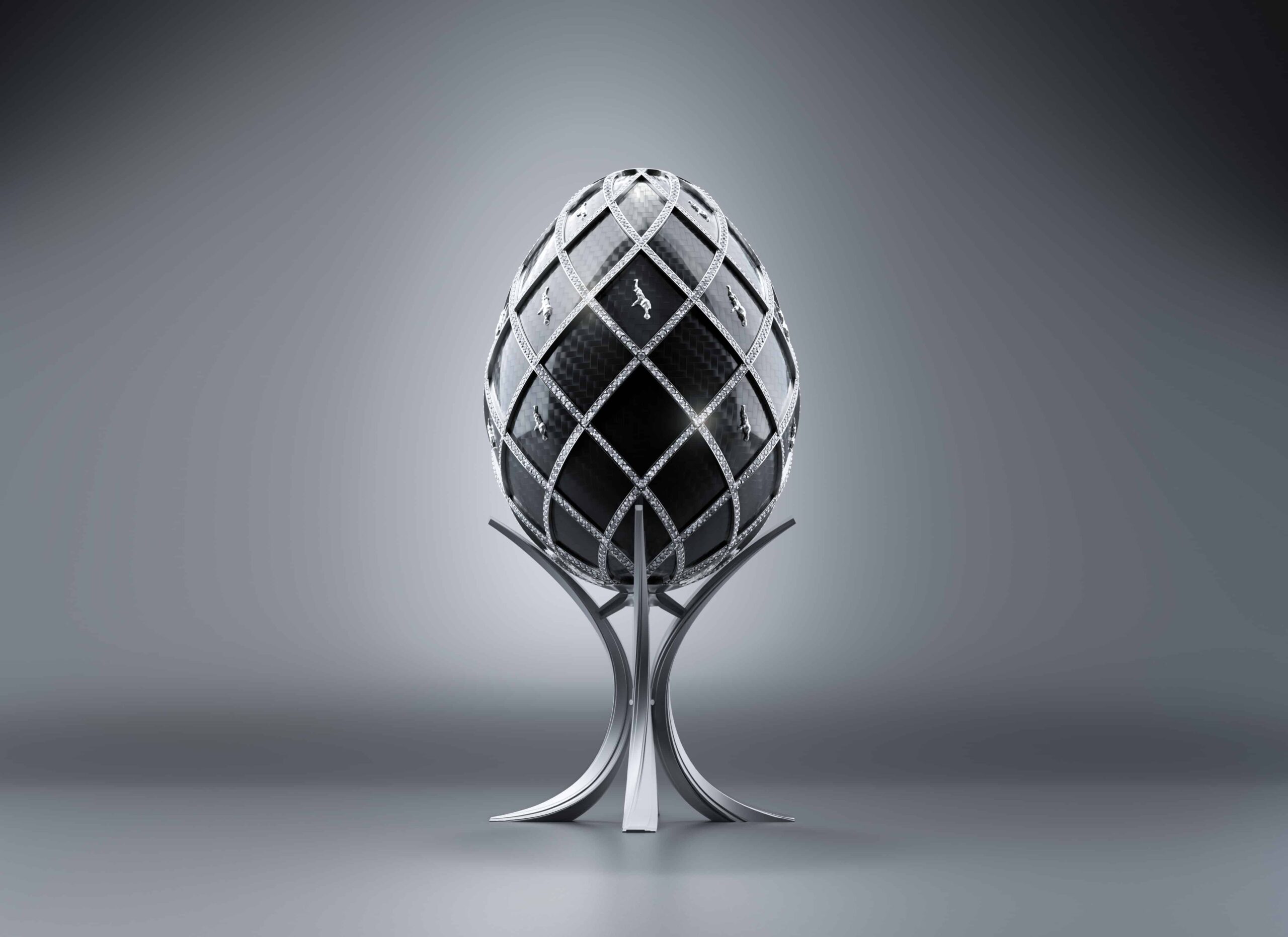

Featured photo : ©Louis Vuitton[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

As a gateway to the brand universe for an aspirational, less affluent clientele, perfume has served as a geographic gas pedal and anti-crisis remedy for luxury companies. While uncertainty is gaining ground, the potential of the Chinese market is giving new importance to this market, to the point that many players want to challenge L’Oréal on its own ground.

The insolent health of Beauty

Although once shaken by Covid, Beauty is now experiencing a rebound in sales, to the point that the major luxury groups are intensifying their diversification and multiplying their investments.

Judging by the number of mergers, acquisitions, and operations in this sector, it has become dynamic and ultra-competitive. L’Oréal, which missed out on the purchase of Byredo in favor of the Spanish group Puig, has just acquired Aesop – the Brazilian group Natura & Co’s nugget valued at 2 billion dollars – under the nose of LVMH and Shiseido. For its part, Estée Lauder has just acquired Tom Ford Beauty and will take over the development of Balmain Beauty. The Coty group has also sold its Lacoste license to Interparfums.

The economic performance of the Beauty category partly explains this renewed interest in the sector, as well as the deteriorated economic context, which forces occasional luxury consumers to make new choices.

L’Oréal, the historic specialist in Beauty, has thus positioned itself particularly well, demonstrating the strategic nature of this accessible luxury product. The L’Oréal luxury division has been THE division of all achievements for the past two years. With 14.6 billion euros in 2022, it has the best sales of the group, an increase of 18.6% as reported, where the growth of the L’Oréal group is only 10.9% on a comparable basis, at 38.26 billion euros. But nothing is more desirable than its operating margin of 22.9% compared with 19.8% for its “consumer” products.

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © Louis Vuitton[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

As a gateway to the brand universe for an aspirational, less affluent clientele, perfume has served as a geographic gas pedal and anti-crisis remedy for luxury companies. While uncertainty is gaining ground, the potential of the Chinese market is giving new importance to this market, to the point that many players want to challenge L’Oréal on its own ground.

The insolent health of Beauty

Although once shaken by Covid, Beauty is now experiencing a rebound in sales, to the point that the major luxury groups are intensifying their diversification and multiplying their investments.

Judging by the number of mergers, acquisitions, and operations in this sector, it has become dynamic and ultra-competitive. L’Oréal, which missed out on the purchase of Byredo in favor of the Spanish group Puig, has just acquired Aesop – the Brazilian group Natura & Co’s nugget valued at 2 billion dollars – under the nose of LVMH and Shiseido. For its part, Estée Lauder has just acquired Tom Ford Beauty and will take over the development of Balmain Beauty. The Coty group has also sold its Lacoste license to Interparfums.

The economic performance of the Beauty category partly explains this renewed interest in the sector, as well as the deteriorated economic context, which forces occasional luxury consumers to make new choices.

L’Oréal, the historic specialist in Beauty, has thus positioned itself particularly well, demonstrating the strategic nature of this accessible luxury product. The L’Oréal luxury division has been THE division of all achievements for the past two years. With 14.6 billion euros in 2022, it has the best sales of the group, an increase of 18.6% as reported, where the growth of the L’Oréal group is only 10.9% on a comparable basis, at 38.26 billion euros. But nothing is more desirable than its operating margin of 22.9% compared with 19.8% for its “consumer” products.

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © Louis Vuitton[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]