[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

Marriott International and Hyatt Hotels Corporation have released their first quarter results. Due to better-than-expected performance, both hotel companies have decided to raise their guidance for the full year 2023.

Marriott International’s reported net income was $757 million, up from $377 million in the previous quarter. Adjusted net income was $648 million, up from $413 million last year.

Marriott saw its global RevPAR increase 34.3 percent. Regionally, RevPAR was up 25.6% in the U.S. and Canada and 63.1% in international markets. EBITDA, meanwhile, rose to $1,098 million from $759 million in Q1 2022.

Marriott’s reported operating income was $951 million, up from $558 million in the same period in 2022, and its reported net income was $757 million, up from $377 million. Finally, reported diluted earnings per share (EPS) posted $2.43, up from $1.14 in the previous quarter.

Marriott added 79 properties (11,015 rooms) to its global lodging portfolio in the first quarter, and 14 properties (2,351 rooms) exited. As a result, it now has 8,400 properties (more than 1,534,000 rooms) worldwide. The hotel group also bought back 6.8 million shares of its common stock for $1.1 billion. Year-to-date through April 28, the company has returned $1.5 billion to its shareholders.

As a result of these results, Marriott announced it is raising its full-year 2023 guidance.

“With the faster-than-expected recovery in international markets and continued strong global booking trends so far in the second quarter, we are raising our full-year RevPAR guidance”, said Anthony Capuano, president and CEO of Marriott International. “We believe our broad portfolio of brands, award-winning Marriott Bonvoy loyalty program, dedicated associates and efficient, asset-light business model position us very well for future growth.”

Hyatt in good shape

Hyatt Hotels Corporation’s net income was $58 million. This contrasts with a net loss of $73 million during the same period in 2022.

Still, Hyatt recorded a 42.9% increase in RevPAR, driven by average price growth, up 12% in constant currency. The company’s adjusted EBITDA increased 58.6% to $268 million.

This put the company’s diluted EPS at $0.53, up from $0.67 in 2022. At the same time, its adjusted diluted EPS was $0.41, up from $0.33. In terms of transactions, the acquisition of Dream Hotel Group was completed on February 2, 2023 for $125 million. In addition, Hyatt has two assets currently up for sale and intends to successfully execute plans to realize $2 billion in gross proceeds from real estate sales by the end of 2024.

28 new hotels (5,128 rooms) joined Hyatt, including the 12 hotels (1,893 rooms) from the Dream Hotel Group acquisition. As of March 31, 2023, Hyatt Hotels Corporation had total debt of $3,102 million. The company has repurchased a total of 1,018,931 shares of Class A common stock for approximately $106 million.

In the face of such results, Hyatt, too, has raised its full-year 2023 guidance.

“For the fourth consecutive quarter, we delivered record results that exceeded our expectations, demonstrating our unique positioning and differentiated model”, says Mark S. Hoplamazian, Hyatt’s president and CEO.“We have raised our full-year RevPAR guidance, while maintaining our record pipeline and industry-leading net room growth.”

Read also >Hotel industry: Baccarat Hotel Dubai to open in 2026

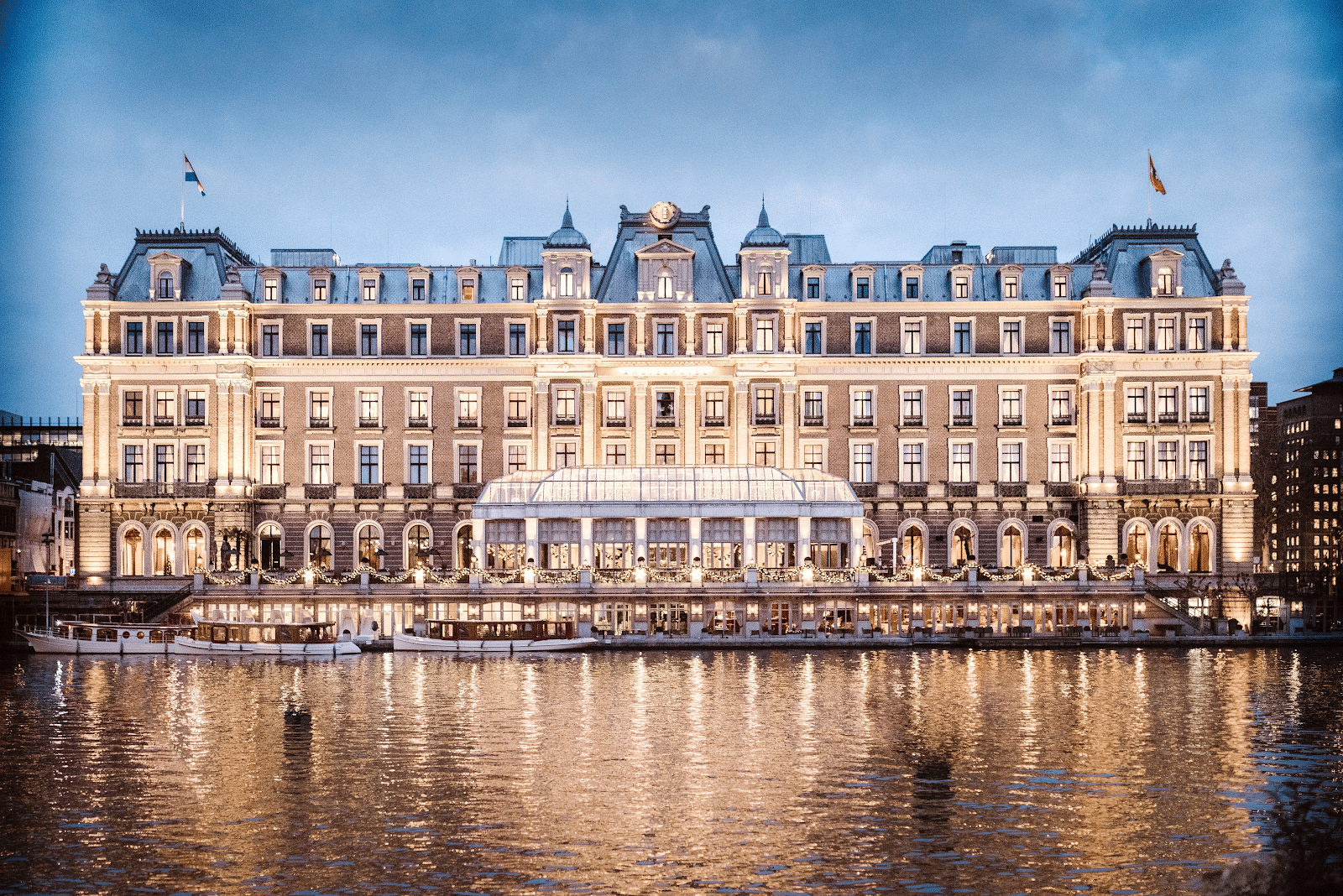

Featured photo : ©Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

Marriott International and Hyatt Hotels Corporation have released their first quarter results. Due to better-than-expected performance, both hotel companies have decided to raise their guidance for the full year 2023.

Marriott International’s reported net income was $757 million, up from $377 million in the previous quarter. Adjusted net income was $648 million, up from $413 million last year.

Marriott saw its global RevPAR increase 34.3 percent. Regionally, RevPAR was up 25.6% in the U.S. and Canada and 63.1% in international markets. EBITDA, meanwhile, rose to $1,098 million from $759 million in Q1 2022.

Marriott’s reported operating income was $951 million, up from $558 million in the same period in 2022, and its reported net income was $757 million, up from $377 million. Finally, reported diluted earnings per share (EPS) posted $2.43, up from $1.14 in the previous quarter.

Marriott added 79 properties (11,015 rooms) to its global lodging portfolio in the first quarter, and 14 properties (2,351 rooms) exited. As a result, it now has 8,400 properties (more than 1,534,000 rooms) worldwide. The hotel group also bought back 6.8 million shares of its common stock for $1.1 billion. Year-to-date through April 28, the company has returned $1.5 billion to its shareholders.

As a result of these results, Marriott announced it is raising its full-year 2023 guidance.

“With the faster-than-expected recovery in international markets and continued strong global booking trends so far in the second quarter, we are raising our full-year RevPAR guidance”, said Anthony Capuano, president and CEO of Marriott International. “We believe our broad portfolio of brands, award-winning Marriott Bonvoy loyalty program, dedicated associates and efficient, asset-light business model position us very well for future growth.”

Hyatt in good shape

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

Marriott International and Hyatt Hotels Corporation have released their first quarter results. Due to better-than-expected performance, both hotel companies have decided to raise their guidance for the full year 2023.

Marriott International’s reported net income was $757 million, up from $377 million in the previous quarter. Adjusted net income was $648 million, up from $413 million last year.

Marriott saw its global RevPAR increase 34.3 percent. Regionally, RevPAR was up 25.6% in the U.S. and Canada and 63.1% in international markets. EBITDA, meanwhile, rose to $1,098 million from $759 million in Q1 2022.

Marriott’s reported operating income was $951 million, up from $558 million in the same period in 2022, and its reported net income was $757 million, up from $377 million. Finally, reported diluted earnings per share (EPS) posted $2.43, up from $1.14 in the previous quarter.

Marriott added 79 properties (11,015 rooms) to its global lodging portfolio in the first quarter, and 14 properties (2,351 rooms) exited. As a result, it now has 8,400 properties (more than 1,534,000 rooms) worldwide. The hotel group also bought back 6.8 million shares of its common stock for $1.1 billion. Year-to-date through April 28, the company has returned $1.5 billion to its shareholders.

As a result of these results, Marriott announced it is raising its full-year 2023 guidance.

“With the faster-than-expected recovery in international markets and continued strong global booking trends so far in the second quarter, we are raising our full-year RevPAR guidance”, said Anthony Capuano, president and CEO of Marriott International. “We believe our broad portfolio of brands, award-winning Marriott Bonvoy loyalty program, dedicated associates and efficient, asset-light business model position us very well for future growth.”

Hyatt in good shape

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : ©Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]