[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

While the number of millionaires continues to grow worldwide, the sale of primary residences and second homes is buoyant in the luxury segment. Americans, and even more so the younger generations, are particularly fond of time-sharing. The strong dollar is pushing them abroad, always Europe, but also more and more, Asia and Central America.

How will luxury real estate, particularly in the United States, change in 2023? A recent report combining a survey of more than 600 Coldwell Banker Global Luxury Property Specialists agents with data from the Institute for Luxury Home Marketing, Wealth-X, Credit Suisse, and other sources provides valuable insight. It broadly addresses the global real estate footprint in the luxury segment, markets of opportunity for buyers and sellers, and, more specifically, multiple homeownership in the United States and abroad. The study also outlines key trends that will influence affluent consumers in 2023.

“The intrinsic value of buying real estate has never been higher as affluent buyers are motivated by lifestyle changes and opportunities in the current market environment. While there may be more discretionary purchases this year, we still expect a higher volume of international buyers, growing influence among young millionaires, and the continued appetite for second homes to drive the market in the 2023 luxury landscape, based on our findings in the report.” points out Michael Altneu, Vice President of Coldwell Banker Global Luxury.

More and more millionaires

According to Credit Suisse, the number of millionaires in the world has never been so high. And it is expected to increase by a further 40% by 2026! By then, one in seven adults will have a net worth of at least 1 million dollars.

A royal road for luxury residences continues to rally the votes of this population, which gives “priority to financial stability, long-term wealth growth, family, health and well-being.”

More than half of Coldwell Banker Global Luxury Property specialists surveyed expect luxury home prices in 2023 to remain flat or increase slightly from 2022. For more than half, demand will remain constant in 2023, but for nearly 30 percent, it could be stronger by the end of the year.

For these wealthy international buyers, the cities with the traditional concentration of wealth will continue to be the most attractive. New York remains their favorite, ahead of Los Angeles, whether they want to live there permanently or make it their second home. But they also like a change of scenery. According to the Coldwell Banker survey, they will also opt for architecturally and culturally different places in the United States, such as Chicago, and luxury resorts like Aspen. But they could also opt for an Asian megacity, which has become an option again since the reopening of the borders, like Singapore, Beijing, and Guangzhou, which rank in the top 10, according to Wealth-X.

In general, “the increased desire to travel, investment opportunities, the growing popularity of dual nationality and “Golden Visas,” and favorable tax laws” make wealthy buyers more inclined to look abroad for their next property purchase.

Selection criteria

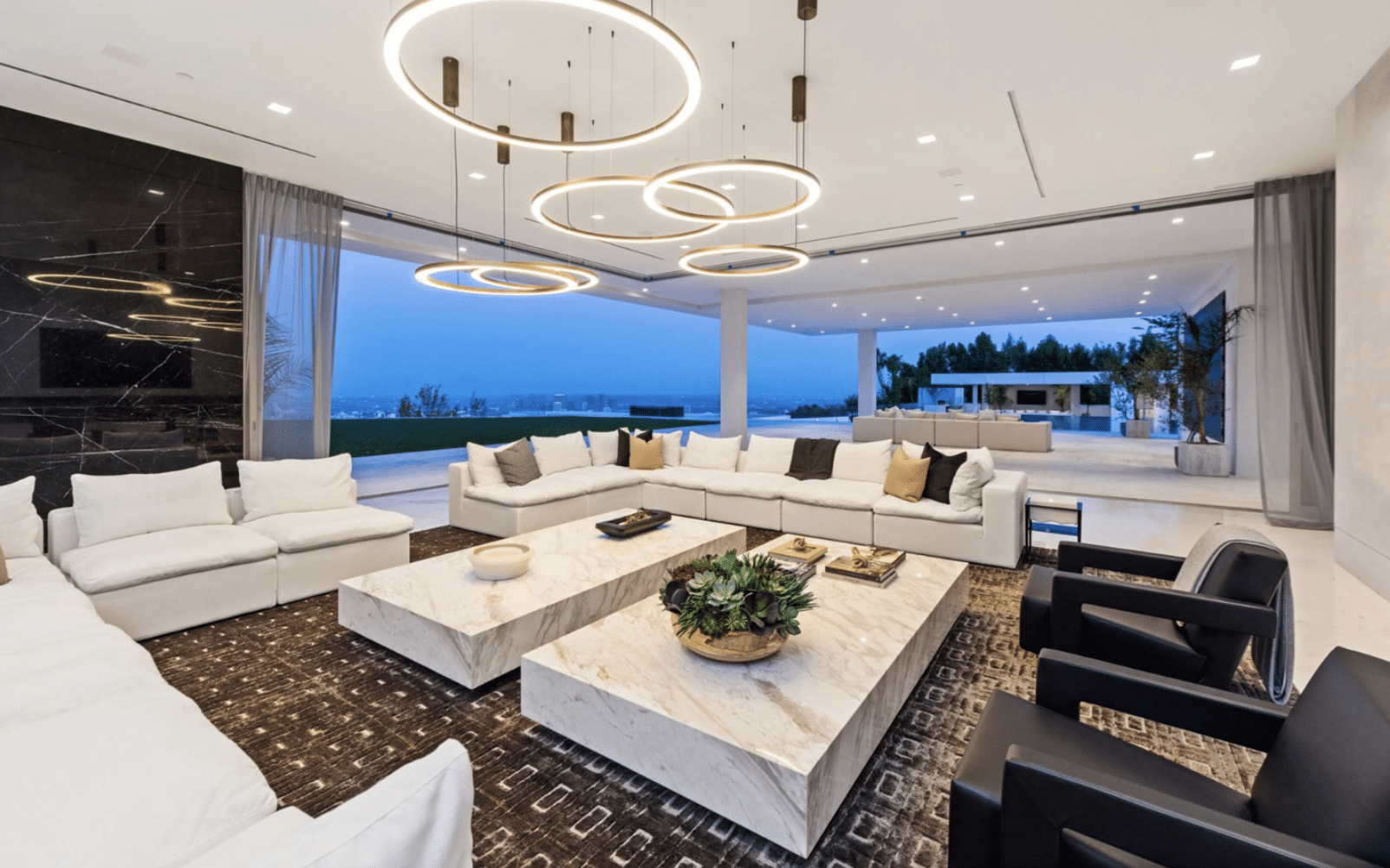

When selecting a primary or secondary residence, the property’s location, the condition of the house, and its equipment are the priorities of wealthy buyers. But “breathtaking views, quality of construction materials, and privacy” are also the top three qualities they cite for their dream home.

In terms of style, “open floor plans, custom architectural elements, and neutral color palettes” are also appreciated by this select clientele. They are also keen on technologies such as home automation systems, energy-efficient appliances, and electric vehicle charging stations.

The Americans in search of timeshares

In Uncle Sam, the real estate market is driven by the underlying trend of multi-property ownership. According to Wealth-X, the percentage of U.S.-based individuals with a wealth of $5 million or more owning two or more properties have rise from 70% in 2021 to 79% in 2022. And according to the Coldwell Banker report, 72% of affluent buyers indicated that their future home purchase would be a second home, vacation home, or rental property.

Gen X and millennials are the first to want to own multiple homes, with an eye toward wealth. They are looking for “hybrid properties” that allow for “part-time getaways and rentals.

According to Wealth-X, the top five U.S. cities and regions for second-home purchases among the wealthy are New York City, Silicon Valley, San Francisco, Los Angeles, and Chicago.

More generally, the cities and regions most likely to be the most buyer-friendly this spring are Marco Island, Palm Beach, and Miami, Florida; Summit County, Colorado; and Lake Tahoe, Nevada. At the same time, the most likely to be buoyant for sellers are St. Louis (Missouri), Hamilton County (Indiana), Richmond (Virginia), Johnson County (Kansas) and the Raleigh-Durham (North Carolina) area.

But the strength of the U.S. dollar and the rising cost of living in the U.S. are also encouraging wealthy Americans to move outside their borders. 91% say they are more likely to own a home abroad, according to Coldwell Banker’s international survey. Already in 2022, according to Wealth-X, more than 64,000 foreign properties were owned by Americans with a wealth of $5 million or more. That’s an increase of 20% over 2021 and 115% over 2020.

And while Europe still attracts many Americans, the emerging continents of Central America and Asia are gaining in popularity. And the phenomenon is even more pronounced among the younger, wealthier generations. In the age of social networks, exotic destinations are very photogenic, and do not lack arguments…

Read also > Sotheby’s: French luxury real estate is not in crisis

Featured photo : © Immobilier Swiss[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

While the number of millionaires continues to grow worldwide, the sale of primary residences and second homes is buoyant in the luxury segment. Americans, and even more so the younger generations, are particularly fond of time-sharing. The strong dollar is pushing them abroad, always Europe, but also more and more, Asia and Central America.

How will luxury real estate, particularly in the United States, change in 2023? A recent report combining a survey of more than 600 Coldwell Banker Global Luxury Property Specialists agents with data from the Institute for Luxury Home Marketing, Wealth-X, Credit Suisse, and other sources provides valuable insight. It broadly addresses the global real estate footprint in the luxury segment, markets of opportunity for buyers and sellers, and, more specifically, multiple homeownership in the United States and abroad. The study also outlines key trends that will influence affluent consumers in 2023.

“The intrinsic value of buying real estate has never been higher as affluent buyers are motivated by lifestyle changes and opportunities in the current market environment. While there may be more discretionary purchases this year, we still expect a higher volume of international buyers, growing influence among young millionaires, and the continued appetite for second homes to drive the market in the 2023 luxury landscape, based on our findings in the report.” points out Michael Altneu, Vice President of Coldwell Banker Global Luxury.

More and more millionaires

According to Credit Suisse, the number of millionaires in the world has never been so high. And it is expected to increase by a further 40% by 2026! By then, one in seven adults will have a net worth of at least 1 million dollars.

A royal road for luxury residences continues to rally the votes of this population, which gives “priority to financial stability, long-term wealth growth, family, health and well-being.”

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © Kering[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

While the number of millionaires continues to grow worldwide, the sale of primary residences and second homes is buoyant in the luxury segment. Americans, and even more so the younger generations, are particularly fond of time-sharing. The strong dollar is pushing them abroad, always Europe, but also more and more, Asia and Central America.

How will luxury real estate, particularly in the United States, change in 2023? A recent report combining a survey of more than 600 Coldwell Banker Global Luxury Property Specialists agents with data from the Institute for Luxury Home Marketing, Wealth-X, Credit Suisse, and other sources provides valuable insight. It broadly addresses the global real estate footprint in the luxury segment, markets of opportunity for buyers and sellers, and, more specifically, multiple homeownership in the United States and abroad. The study also outlines key trends that will influence affluent consumers in 2023.

“The intrinsic value of buying real estate has never been higher as affluent buyers are motivated by lifestyle changes and opportunities in the current market environment. While there may be more discretionary purchases this year, we still expect a higher volume of international buyers, growing influence among young millionaires, and the continued appetite for second homes to drive the market in the 2023 luxury landscape, based on our findings in the report.” points out Michael Altneu, Vice President of Coldwell Banker Global Luxury.

More and more millionaires

According to Credit Suisse, the number of millionaires in the world has never been so high. And it is expected to increase by a further 40% by 2026! By then, one in seven adults will have a net worth of at least 1 million dollars.

A royal road for luxury residences continues to rally the votes of this population, which gives “priority to financial stability, long-term wealth growth, family, health and well-being.”

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © Kering[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]