[vc_row njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

The third and final part of the Cetelem Observatory study, entitled “Luxury, a necessary superfluity today?” was published on December 14, 2020.

The Cetelem Observatory publishes the final part of its study on the luxury sector and the lifestyles of its consumers, divided into three phases and three waves of surveys. Each year, these zooms study the consumption patterns of French people on various social issues. The first part of the study, published in October 2020, analyzed luxury made in France, and the second part, released on December 7, focused on responsible consumption in the luxury sector.

To conclude this study on the luxury sector, the Cetelem Observatory focuses on the issue of luxury consumers‘ forecasts and expectations, particularly as the end of the year approaches. How do the French intend to buy luxury, and through which channels? The study looks at these key questions in the study on purchasing, budgeting, and above all how do the French pay for luxury goods, both large and small?

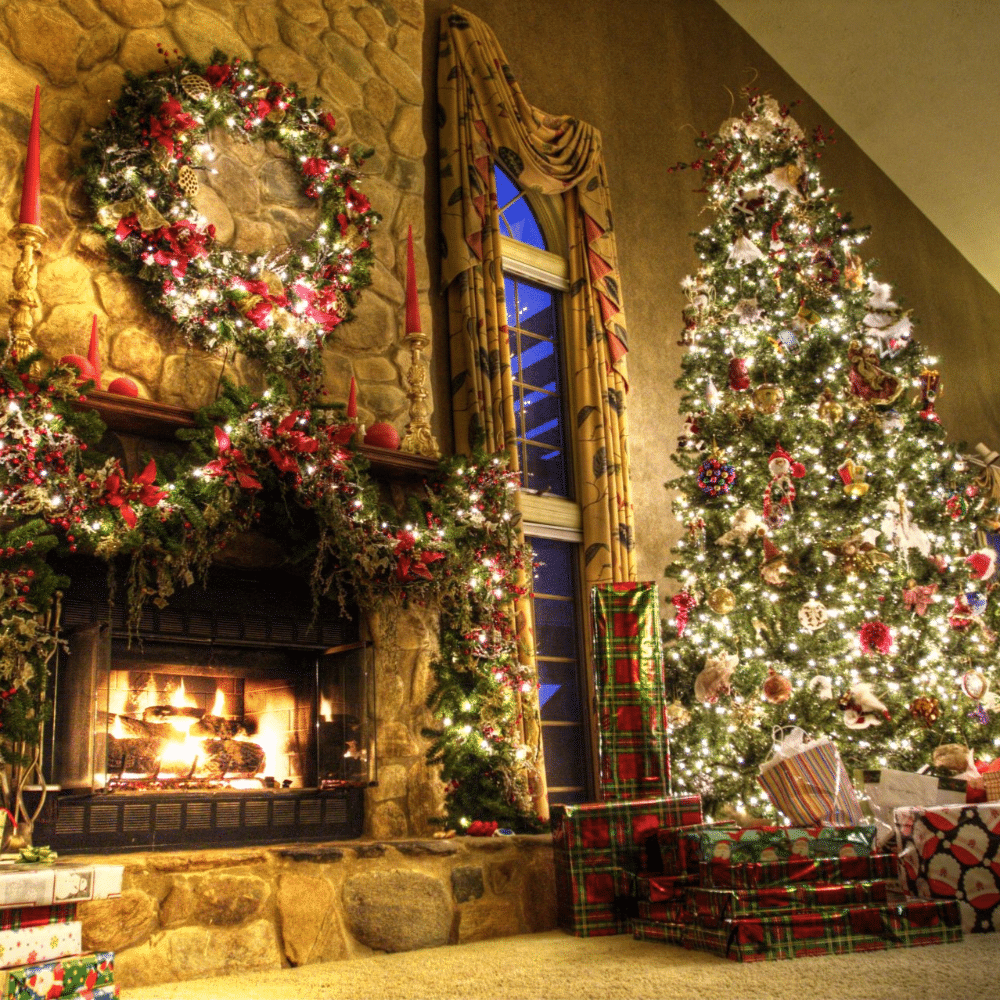

A holiday season marked by the health crisis

Surveys highlight the fact that 72% of French people, especially young consumers, offer their loved ones food products (51%) or luxury experiences (32%). For New Year’s Eve dishes, on the menu are chocolate, salmon, log and foie gras are on the menu of more than 8 out of 10 French people.

At the same time, nearly half of the French (52%) say they do not particularly want to take advantage of the end of the year to treat themselves, because, in the context of the health crisis linked to Covid-19, they do not have the spirit to celebrate. A third of the French people plan a lower budget than last year.

The way of buying gifts is likely to be very different this year. More than a quarter (26%) of French people plan to make more purchases online for Christmas gifts than last year. Almost as many gifts will be bought on the web (76%) as in physical stores (82%), a change from the usual channel also linked to the health crisis.

The shift to digital taken by the luxury sector is generally well-received, generally perceived as a way to bounce back in the current context by 84% of those surveyed, and as a way to target a new clientele (young people, foreign customers) by 83%.

Most French people (57%) consider that the emergence of platforms such as Amazon or CDiscount has little impact on the luxury business, with a large majority of the population (64%) preferring, in any case, to buy luxury products in stores. However, three-quarters of French people (75%) consider that small retailers are disadvantaged by this digital competition.

The French prefer accessible luxury

The luxury products or experiences that seem most accessible to the French are often in the area of daily well-being: a spa or massage session seems accessible to 69% of the population, a luxury perfume to 67%, and a cosmetic product to 58%. On the other hand, the most expensive investments are represented by the luxury car, which 21% consider accessible, the work of art (22%), or the luxury jewelry, considered accessible by 33%.

At the same time, many French people want what is within their reach: for example, spa or massage sessions (62%), the restaurant experience (58%), and luxury perfume (57%) are among the most cherished pleasures. Generally speaking, the various luxuries seem as accessible as they really are desired, with the exception of the luxury car, which more than 4 out of 10 French people (43%) would like to treat themselves to. The survey shows that nearly two-thirds of French people (64%) say they prefer rarity to regularity.

The French like to treat themselves to small luxuries, rather related to the gastronomy sector, such as a trip to the restaurant (63%) or a more prestigious branded food product than usual (50%). The purchase of a piece of clothing from a luxury house or high-end boutique appeals to 33% of the French, while a spa/massage session would appeal to 28%. Among young consumers, understood as those under 35 years old, there is a greater willingness to treat themselves to travel (44% versus 34% on average), fashion items (50% versus 33%), or objects solely for pleasure (50% versus 33%).

In addition, the Cetelem Observatory study highlights the fact that men and women do not necessarily covet the same types of luxury. While they are equally attracted to clothing, eyewear, furniture, and opera tickets, this is less the case for spa/massage experiences, perfumes, cosmetics, jewelry, and other bags, which are preferred by women, while dining experiences, cars, digital products, watches and works of art are more popular with men.

Featured Photo : © Press[/vc_column_text][/vc_column][/vc_row]