[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

As one of the world’s biggest consumers of luxury goods, South Korea is attracting a great deal of interest from brands in the sector. Although little-known, the Land of the Morning Calm is the fifth largest luxury goods market in the world. It’s a region of the world with a passion for both experimentation and major brands.

Let’s continue our journey in the Land of the Morning Calm. After the strategy of catwalk shows and luxury brand shop openings, let’s move on to the specific nature of this market, which has become one of the largest in the world.

It’s a market that’s all the more strategic because it was still exceptionally strong when China was in the grip of an uncontrollable pandemic.

The continuing abundance of luxury goods in Asia

Bain estimates that the Korean luxury goods market will be worth €21 billion by 2022. This represents spectacular growth of 45% on a comparable basis. In 2021, the market grew by just 5% on a comparable basis to €12 billion.

As Joëlle de Montgolfier, Executive Vice President of consulting firm Bain, points out, “the Korean market has become the fifth largest luxury goods market in the world. While the leading luxury goods market is still the United States ($98 billion), China ($59 billion) and Japan (€24 billion) are the second largest players in the industry, followed by Italy. South Korea follows, ahead of France“.

However, the Korean market is much more concentrated than in China, where the bulk of major luxury buyers are in 3rd and 4th tier cities, which increases the need to refine e-commerce strategy.

Seoul accounts for 60% of spending on luxury goods in the country, according to data from Bain.

Highly exposed to the rest of the world thanks to an integrated smartphone economy and super applications – like China and its WeChat – this market brings together “old money” customers with a strong attraction for novelty and experimentation with others who are newly enriched, sharing a pronounced taste for leather goods and accessories from major brands such as Chanel or Dior.

For Pascale Elmalan, CEO of marketing and international development consultancy A.X.I.A.N Partners, it’s a fact: “If you attack the Korean market and you don’t know what Zepeto and Glowpink are, you’re off to a bad start. The reason being that in this part of the world, they are not used to Google search.”

But what is most surprising about this country is the speed with which it has been able to turn around its economy, which has nothing to envy China’s rise.

And the Korean Tiger surprises the Chinese Dragon

In Korea, the tiger or Goryeobeom (호랑이) is a symbol of strength and power. A companion of Sansun, the mountain god, he is often regarded as the guardian spirit and protector of the Korean people. It also plays a central role in the mythical founding of Korea by Dangun (단군) with the kingdom of Joseon (조선) or GoJoseon.

Indeed, the country has long been dubbed “the land of tigers“, and even “the home of extraordinary individuals who know how to tame the tiger”. Although these wild felines have disappeared from the country – notably due to their systematic extermination by the Japanese occupiers – one of them occupies a special place: the white tiger or Soohorang (수호랑). There is a popular belief that when a tiger has overcome many obstacles and finally understands the meaning of life, its fur turns white and the tiger becomes a sacred spirit.

Judging by South Korea’s ability to transform its economy at breakneck speed and lift its population out of extreme poverty, the allegory is far from overrated.

Indeed, with the financial clout of its chaebols (재벌) – family-owned conglomerates like Samsung, LG and Hyundai – themselves inspired by the Japanese zaïbatsu, the country has become sophisticated in the creation and massive, pan-Asian export of cultural products (which we’ll be looking at in our next summer survey).

This wisdom is reminiscent of the Dragon, symbol of the changing forces of nature, which usually refers to China’s neighbour, in other words the country that has long overshadowed the Land of the Morning Calm. Indeed, the economic miracle that began to take shape in the 1980s in South Korea, but also in Taiwan, Singapore and Hong Kong, gave rise to the Four Asian Dragons.

As Joëlle de Montgolfier (Bain) points out, “In the space of 60 years, South Korea has made a spectacular comeback in the world economy, going from a GDP equivalent to that of Morocco in 1960 to one of the countries with the highest GDP per capita in the world.”

Vincenzo Cicchelli, sociologist, researcher at the University of Paris II and co-author of the book K-pop, Soft Power et culture globale, confirms this, “At the end of the Korean War (1951-1953), the country – which had also suffered Japanese occupation (1905-1945) – was one of the poorest countries in the world, surpassed only by Bangladesh.”

This was in stark contrast to North Korea, which was more modern in that it had benefited from investment in heavy industry, typical of Soviet countries, with strong support from the USSR and Maoist China.

One of the directors of Samsung C&T – the construction arm of the Korean chaebol – Shin Kim, recalled this in 2016 at the Koafec summit (African Development Bank and Korea-Africa Economic Cooperation Fund): “In the 1960s, Korea’s main exports were agricultural products and wigs… Koreans were so poor that they had to sell their hair.”

But this ‘compressed‘ growth in the space of 50 years was facilitated by solid fundamentals.

We’ll look at these in a fourth and penultimate section.

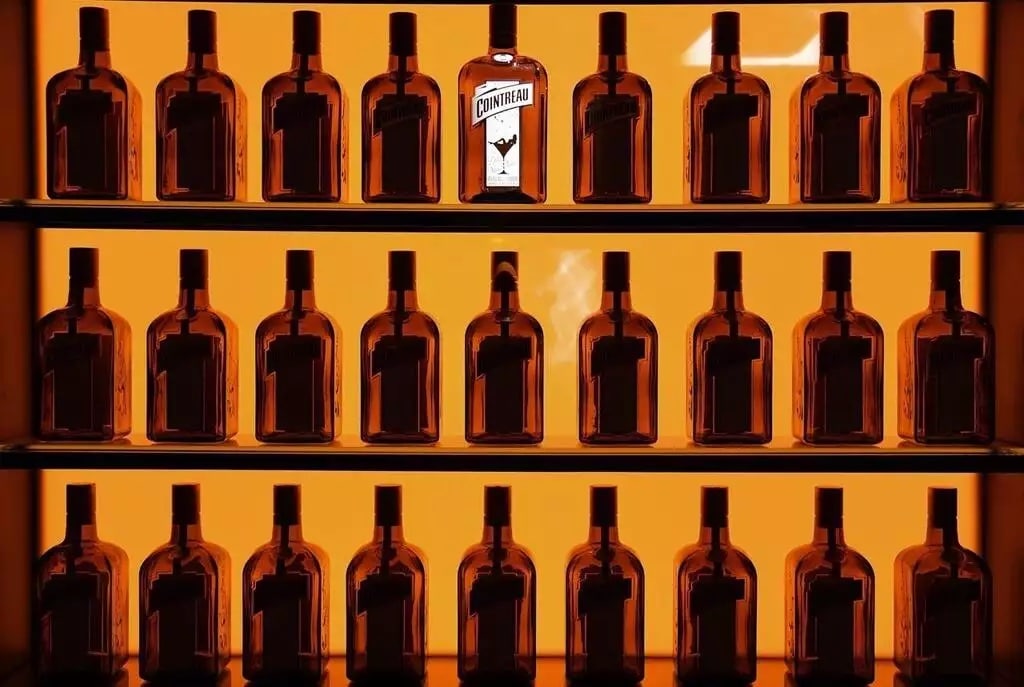

Featured photo : © Press [/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

As one of the world’s biggest consumers of luxury goods, South Korea is attracting a great deal of interest from brands in the sector. Although little-known, the Land of the Morning Calm is the fifth largest luxury goods market in the world. It’s a region of the world with a passion for both experimentation and major brands.

Let’s continue our journey in the Land of the Morning Calm. After the strategy of catwalk shows and luxury brand shop openings, let’s move on to the specific nature of this market, which has become one of the largest in the world.

It’s a market that’s all the more strategic because it was still exceptionally strong when China was in the grip of an uncontrollable pandemic.

The continuing abundance of luxury goods in Asia

Bain estimates that the Korean luxury goods market will be worth €21 billion by 2022. This represents spectacular growth of 45% on a comparable basis. In 2021, the market grew by just 5% on a comparable basis to €12 billion.

As Joëlle de Montgolfier, Executive Vice President of consulting firm Bain, points out, “the Korean market has become the fifth largest luxury goods market in the world. While the leading luxury goods market is still the United States ($98 billion), China ($59 billion) and Japan (€24 billion) are the second largest players in the industry, followed by Italy. South Korea follows, ahead of France“.

However, the Korean market is much more concentrated than in China, where the bulk of major luxury buyers are in 3rd and 4th tier cities, which increases the need to refine e-commerce strategy.

Seoul accounts for 60% of spending on luxury goods in the country, according to data from Bain.

Highly exposed to the rest of the world thanks to an integrated smartphone economy and super applications – like China and its WeChat – this market brings together “old money” customers with a strong attraction for novelty and experimentation with others who are newly enriched, sharing a pronounced taste for leather goods and accessories from major brands such as Chanel or Dior.

For Pascale Elmalan, CEO of marketing and international development consultancy A.X.I.A.N Partners, it’s a fact: “If you attack the Korean market and you don’t know what Zepeto and Glowpink are, you’re off to a bad start. The reason being that in this part of the world, they are not used to Google search.”

But what is most surprising about this country is the speed with which it has been able to turn around its economy, which has nothing to envy China’s rise.

And the Korean Tiger surprises the Chinese Dragon

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

As one of the world’s biggest consumers of luxury goods, South Korea is attracting a great deal of interest from brands in the sector. Although little-known, the Land of the Morning Calm is the fifth largest luxury goods market in the world. It’s a region of the world with a passion for both experimentation and major brands.

Let’s continue our journey in the Land of the Morning Calm. After the strategy of catwalk shows and luxury brand shop openings, let’s move on to the specific nature of this market, which has become one of the largest in the world.

It’s a market that’s all the more strategic because it was still exceptionally strong when China was in the grip of an uncontrollable pandemic.

The continuing abundance of luxury goods in Asia

Bain estimates that the Korean luxury goods market will be worth €21 billion by 2022. This represents spectacular growth of 45% on a comparable basis. In 2021, the market grew by just 5% on a comparable basis to €12 billion.

As Joëlle de Montgolfier, Executive Vice President of consulting firm Bain, points out, “the Korean market has become the fifth largest luxury goods market in the world. While the leading luxury goods market is still the United States ($98 billion), China ($59 billion) and Japan (€24 billion) are the second largest players in the industry, followed by Italy. South Korea follows, ahead of France“.

However, the Korean market is much more concentrated than in China, where the bulk of major luxury buyers are in 3rd and 4th tier cities, which increases the need to refine e-commerce strategy.

Seoul accounts for 60% of spending on luxury goods in the country, according to data from Bain.

Highly exposed to the rest of the world thanks to an integrated smartphone economy and super applications – like China and its WeChat – this market brings together “old money” customers with a strong attraction for novelty and experimentation with others who are newly enriched, sharing a pronounced taste for leather goods and accessories from major brands such as Chanel or Dior.

For Pascale Elmalan, CEO of marketing and international development consultancy A.X.I.A.N Partners, it’s a fact: “If you attack the Korean market and you don’t know what Zepeto and Glowpink are, you’re off to a bad start. The reason being that in this part of the world, they are not used to Google search.”

But what is most surprising about this country is the speed with which it has been able to turn around its economy, which has nothing to envy China’s rise.

And the Korean Tiger surprises the Chinese Dragon

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Press [/vc_column_text][/vc_column][/vc_row]