[vc_row njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

The power of its brand and the resilience of its unique business model have made the Hermès share the second best performer in the flagship index since the beginning of the year, far ahead of the other French giants in the luxury sector, LVMH and Kering.

In the midst of a health and (soon) economic crisis, the French luxury giant is proving to be extremely resilient, both operationally and on the stock market.

Indeed, the luxury house Hermès is withstanding the coronavirus crisis better than its competitors and is seeing its business rebound strongly in China after the reopening of stores.

While its competitors reported double-digit revenue declines in the first quarter (-17% for LVMH, -16.4% for Kering), Hermès recorded only a limited 7.7% decline in sales. Clearly below the consensus forecast of a 13% decline.

Hermès even allowed itself the luxury of achieving record sales of nearly $3 million in a single day when it reopened its flagship store in Guangzhou.

At the end of 2019, the Covid-19 crisis first hit China, a crucial market for the luxury sector, before spreading to the rest of the world.

On March 16, Europe, including France and Italy, and then the United States, had to deal with containment measures and thus the closure of non-essential stores.

The second best performance of the CAC 40

That said, the power of the luxury brand and the resilience of its unique business model have enabled it to be the second best performer on the CAC 40 since the beginning of the year, with a 10.8% gain, well ahead of the other French giants in the luxury sector, LVMH and Kering.

To date, the group led by Bernard Arnaud (LVMH) has lost 6.3% and that of François-Henri Pinault (Kering), 18.5%.

While the share even reached an all-time high on 5 June at 786.2 euros, bringing the group’s valuation to some 82 billion euros.

The group headed by Axel Dumas is thus one of the top five largest capitalisations on the CAC.

“At the height of the crisis, investors did not look at valuation levels at all – Hermès shares were valued at up to 50 times their expected earnings in 2021 – but took refuge in growth stocks with healthy balance sheets. The Group has a cash position of more than €3 billion,” observes John Plassard, Deputy Chief Investment Officer at Mirabaud Securities.

Asia, the Group’s huge growth driver

Indeed, we can see the importance of Asia in sales growth. Although France is on a par with Japan (13% of revenues in 2019).

Asia-Pacific remains the number one in terms of sales with a rate of 51% of revenues in 2019 against 45% in 2010. Japan’s share having dropped from 19% to 13% over the same period.

Asian customers, especially Chinese, have therefore driven Hermès’ sales growth over the past decade.

The consulting firm Bain & Company noted that these clients are increasingly making purchases in their own countries.

As a result, sales in China have grown twice as fast as spending by Chinese clients abroad in recent years.

Now they alone account for 33% of global spending on luxury goods. According to Bain & Company, this share could increase to 46% by 2025.

There are 126 Hermès stores in Asia, compared to 113 in Europe. This also enabled the brand to limit breakage during the first quarter of the year.

The group was able to reopen almost all of its stores in the Middle Kingdom as of 27 February, after closing almost half of its network of 26 stores at the height of the pandemic.

Hermès also relies on an incomparable, even timeless, brand image to withstand the crisis better than its competitors.

Remember that between 2006 and 2008, a period during which the brand posted sales growth of +26%, well ahead of LVMH and Kering (+21% and +8% respectively).

The most iconic products

“In times of recession, Hermès is typically the most resilient business and action, thanks to its high desirability, especially of its most iconic products,” says Luca Solca, sector analyst at Bernstein.

Note that between 1980 and 2017, Birkin bags, the most expensive in the world at 7,000 euros per bag, proved to be a better investment than gold and the S&P 5000. The average annual return for the bag was +5.3% for the S&P and +2.1% for an ounce of gold.

Moreover, the famous bag has never declined since its creation, which is explained by the very low number of units on the market.

Each one is handmade from start to finish by a single craftsman who signs his signature on it.

In the ranking of the world’s most powerful and best-valued brands compiled by the research firm Interbrand based on the brand’s influence on purchasing decisions, financial performance, brand strength in its market and an assessment of future revenues, Hermès ranked 28th worldwide in 2019, four places higher than in 2018.

Since the last financial crisis, the value of the Hermès brand alone would have risen from $4.6 billion in 2009 to $17.9 billion in 2019. And within the sector, Hermès is now second only to Louis Vuitton (22nd place, $32.2 billion) and Chanel (28th place, $22.1 billion).

As you will have understood, nothing can stop Hermès even in the midst of a health crisis, the French luxury giant is proving its resilience.

Read also > CORONAVIRUS: HERMÈS REPORTS A 6.5% DROP IN FIRST-QUARTER SALES

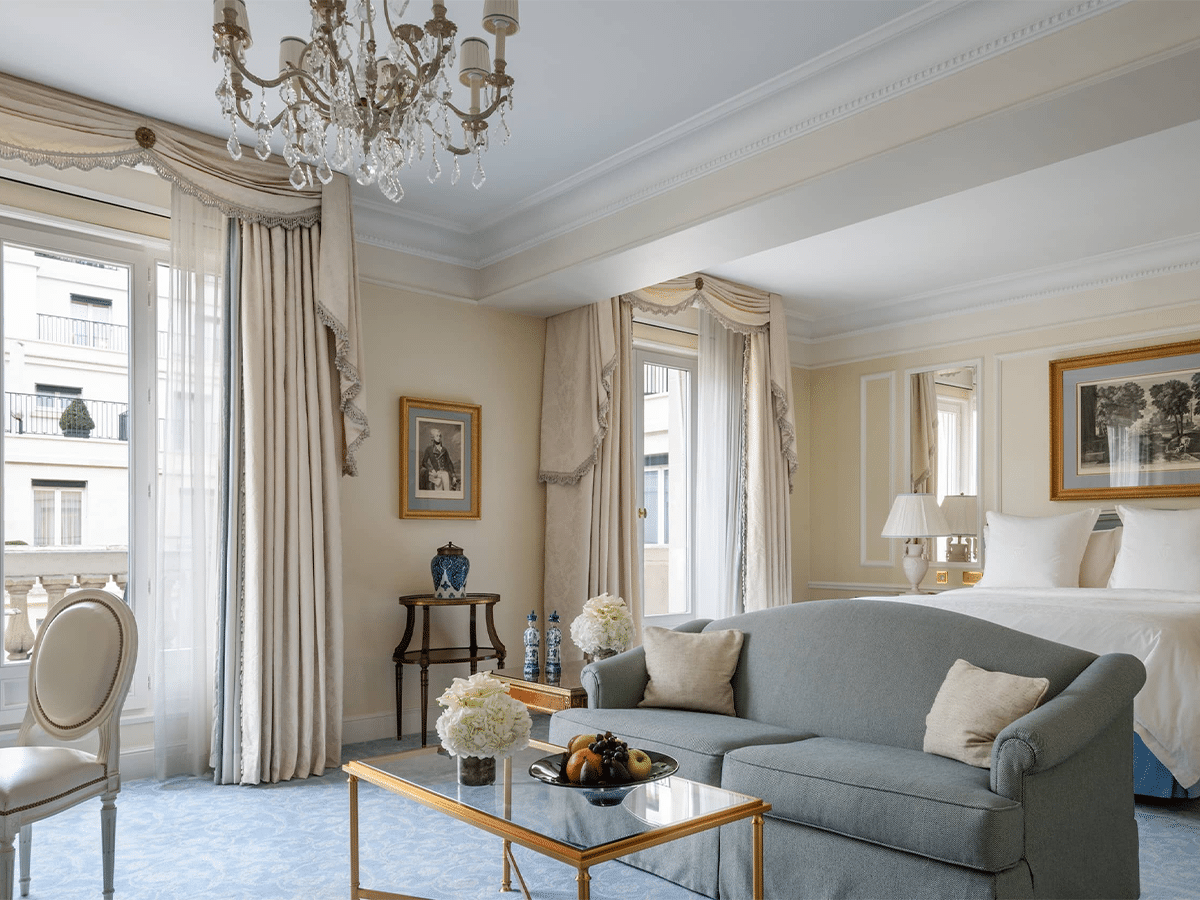

Featured Photo : © Hermès[/vc_column_text][/vc_column][/vc_row]