[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

Neiman Marcus Group announced the closing of Farfetch’s minority investment, but investors take a dim view of the latter’s gamble.

Neiman Marcus Group, the largest integrated luxury retailer in the U.S. and the parent company of Neiman Marcus and Bergdorf Goodman, announced yesterday, Tuesday, the closing of a $200 million minority common stock investment by Farfetch, the luxury e-commerce platform, and the signing of commercial agreements with Farfetch Platform Solutions (FPS). Proceeds from the transaction will be used to accelerate growth and innovation by investing in technology and digital.

“Farfetch’s investment demonstrates their confidence in our omnichannel strategy, and we look forward to partnering with them to continue to revolutionize the luxury customer experience and bring value to all of our stakeholders,” enthuses Geoffroy van Raemdonck, CEO of Neiman Marcus Group.

However, Farfetch’s investment is not to everyone’s liking, especially not to investors. Indeed, at the end of the session on Tuesday, Farfetch’s share price had lost nearly 8%. And even though the two companies promise that “The partnership between Neiman Marcus Group and Farfetch brings together the resources of two industry leaders with a shared commitment to creating a seamless experience for customers“, investors seem to fear that it will take a lot of effort and time for Farfetch to recoup the expense.

In addition, investors are also seeing mixed results with gross merchandise volume for the first quarter ended March 31, 2022, up 1.7% from the first quarter of 2021 to $930.8 million. Revenues increased by 6.1% to $514.8 million.

Commenting on the results, José Neves, Farfetch’s founder and CEO, remained optimistic: “Our core business remains very strong, despite the events in China and the shutdown of operations in Russia, which have impacted our performance and outlook. We are seeing strong market growth in the Americas and the Middle East, our relationships with our customers and luxury brands are strengthening, and we continue to make progress towards our mission of building our global luxury platform.”

Read also > RICHEMONT: WHY A DEAL WITH FARFETCH IS NOT GUARANTEED?

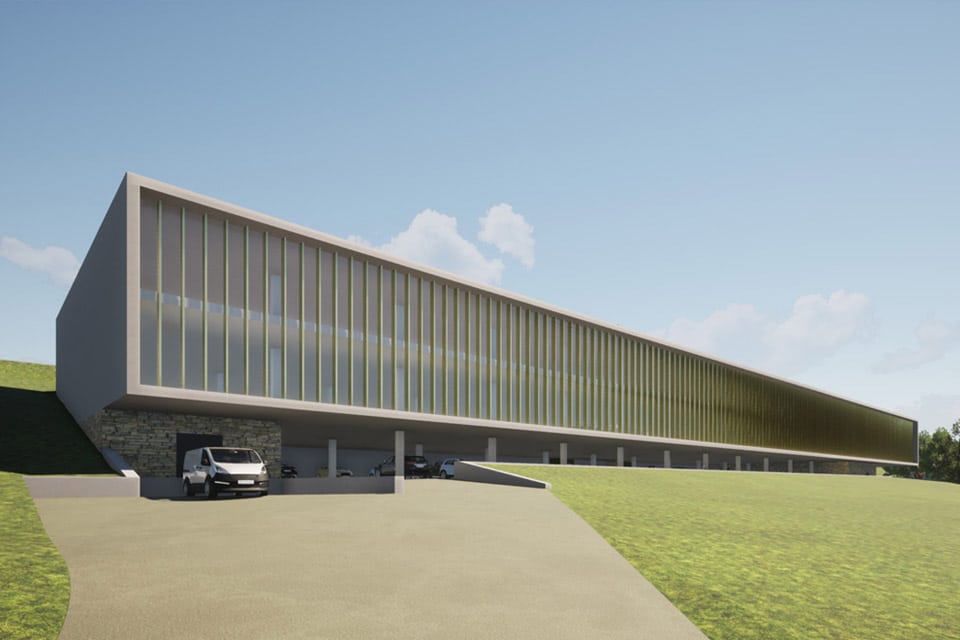

Featured photo : © Farfetch[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

Neiman Marcus Group announced the closing of Farfetch’s minority investment, but investors take a dim view of the latter’s gamble.

Neiman Marcus Group, the largest integrated luxury retailer in the U.S. and the parent company of Neiman Marcus and Bergdorf Goodman, announced yesterday, Tuesday, the closing of a $200 million minority common stock investment by Farfetch, the luxury e-commerce platform, and the signing of commercial agreements with Farfetch Platform Solutions (FPS). Proceeds from the transaction will be used to accelerate growth and innovation by investing in technology and digital.

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Farfetch[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

Neiman Marcus Group announced the closing of Farfetch’s minority investment, but investors take a dim view of the latter’s gamble.

Neiman Marcus Group, the largest integrated luxury retailer in the U.S. and the parent company of Neiman Marcus and Bergdorf Goodman, announced yesterday, Tuesday, the closing of a $200 million minority common stock investment by Farfetch, the luxury e-commerce platform, and the signing of commercial agreements with Farfetch Platform Solutions (FPS). Proceeds from the transaction will be used to accelerate growth and innovation by investing in technology and digital.

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo © Farfetch[/vc_column_text][/vc_column][/vc_row]