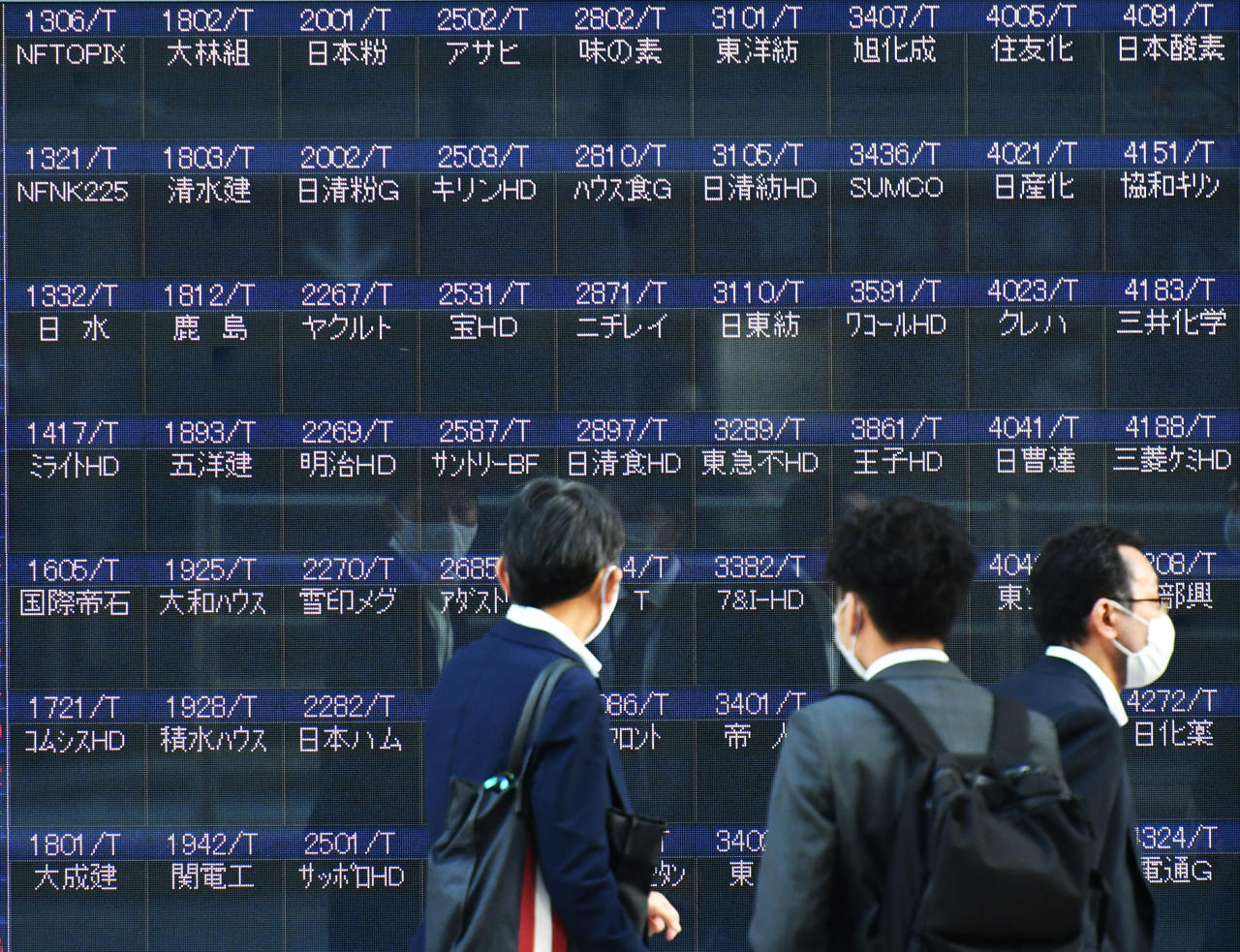

This Thursday, Japanese shares have experienced a sharp decline related to the state of emergency that may be reinstated in the country in the face of the resurgence of cases of Covid-19 in the Japanese archipelago.

As Japan prepares to declare its fourth state of emergency since the beginning of the pandemic, which will last until the Tokyo Olympics, Japanese stocks are in retreat.

Although some restrictive measures have already been taken throughout the country, the city of Tokyo is preparing for stricter rules, such as the ban on the sale of alcohol in restaurants, announced by the Japanese Minister of the Economy, Yasutoshi Nishimura.

These restrictive measures worry investors about the state of the country and the last hopes of recovery, swept away by the arrival of the Delta variant, and strongly impacting the Japanese stock market.

This is the case, for example, the Nikkei index, which fell 0.88% to 28,118.03, its lowest level in over two weeks, while the Topix, fell 0.90% to 1,920.32.

“The reintroduction of the state of emergency is one of the reasons why investors are reluctant to buy Japanese stocks,” said Shigetoshi Kamada, managing director of the research department at Tachibana Securities, interviewed by Reuters.

The Tokyo Olympics will be held from July 23 to August 8, and its organizers will be forced to announce in the next few days that they will not be able to accommodate the public

“The Olympics can be seen as negative for the market. If they are held successfully without the spread of the disease, it may mitigate the negative effect on the market,” said Yusuke Maeyama, researcher at NLI Research.

With the downturn, the short-term effect on Japanese traders is to reignite concerns and that traders will shy away from selling exchange-traded funds in order to get cash to easily pay their dividend.

Retailers in the country also recorded a decline, and for Isetan Mitsukoshi Holdings and the Marui Group, the decline was 3.1% and 2% respectively. The supermarket chain Aeon ended with a decline of 0.8%.

Retailer and materials manufacturer Showa Denko was down 1.9%, a fall linked to revelations of its plan to sell poorly performing lead-acid batteries to the Japanese private equity fund Advantage Partners.

The manufacturer of air conditioning Daikin Industries recovered 3.7% following the report of Nikkei, which announced the launch of an innovation in refrigerant to electric vehicles that could increase their range up to 50%.

Read also > SLIGHT DECLINE IN THE PARIS STOCK MARKET

Featured photo : © Press