[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

At this complicated beginning of the year, many observations can be made regarding the financial strategies implemented by the luxury industry players. Companies are experiencing a slight economic recovery and are preparing to start the year 2021 in the best possible way, notably with mergers and acquisitions. Analysis.

The pandemic will have hit the luxury industry hard, particularly in the fashion and luxury goods sector. Few brands will continue to be independent apart from Chanel, Hermès and Rolex according to Erwan Rambourg, who wrote “Future luxury” and Managing Director and Global Head of Consumer and Retail Equity Research. Indeed, most of them will either go bankrupt, be acquired or merge with others.

As for the major brands that go bankrupt, they never disappear permanently, they convert or reappear under another name or new ownership. This is the case, for example, of Barneys which, after going bankrupt and being bought out by Authentic Brands, plans to open a unit in 2021 located in the New York flagship of Saks Fifth Avenue.

The last quarter of last year was also marked by three of the largest acquisitions, one of which was the largest transaction ever made in the luxury goods sector: in October, the acquisition of Tiffany and Co by LVMH for $15.8 billion. In November, VF Corporation, owner of Timberland, Vans and The North Face, purchased the Supreme streetwear brand for $2.1 billion. And finally, in early December, Moncler acquired the Stone Island men’s clothing brand for $1.4 billion.

This phenomenon of mergers and acquisitions is expected to continue over the coming year 2021 according to many analysts in the luxury sector. The advantage for companies in a good financial position is that borrowing costs remain extremely low compared to historical norms.

“Covid has added to the demand pressure a very concentrated number of winning brands, creating the right conditions for selling to others, merging with others or joining forces to expand, but also to leverage expertise or talent“, says Francesca Di Pasquantonio, Head of Luxury Goods, Equity Research at Deutsche Bank.

According to Tommaso Nastasi, a partner at Deloitte Italy, which monitors transactions in the luxury sector, there are three reasons for mergers and acquisitions: conglomerates looking for a consolidation opportunity, luxury brands intensifying vertical integration by investing in the struggling parts of their supply chain, and a focus on investing in digital expertise and the Asia-Pasific region.

Depending on the objectives, several factors need to be taken into account: are they long term or short term objectives? What type of brands are attractive in terms of investment? In which sector?

For example, the acquisition of Tiffany represents a long-term objective for LVMH, which wants to reproduce the strategy it had implemented for the Bulgarian jewelry business, which enabled it to double its revenue since its acquisition in 2011.

“Contemporary fashion brands that offer good value for money and a good product” are, according to Mr. Nastasi, the targets of Asian brands. Indeed, they find an echo with the young generations and therefore promise an interesting future.

Speaking of Asian players and markets elsewhere, Alibaba and Richemont unveiled their plans to invest $300 million each in Farfetch and $250 million each in Farfetch China in order to “offer luxury brands better access to the Chinese market and to accelerate the digitization of the global luxury industry“.

“The main objective of M&A (mergers and acquisitions) is currently to focus on the brands most exposed to the younger generation, no one is rushing to buy more mature brands. Turning them towards the younger generation could be an opportunity to create value, but it is difficult to do so at the same time”. This is the first time that the company has been able to develop a new product“, said Paola Carboni, analyst at the Italian bank Equita, regarding the purchases of Stone Island, Supreme and the Italian streetwear brand GCDS.

The purpose of these investments is therefore to diversify the brand, to extend it, to reach a different type of clientele, a different market, and of course to make a profit. And for this, all investments are good, even if the brand diversifies by buying a brand whose products sold are unsuitable, that the sector is completely different. Only the objective in sight is important: to reach the most consumers.

Read also > BUSINESS : TIFFANY SHAREHOLDERS APPROVE THE BUYBACK PROPOSAL MADE BY LVMH

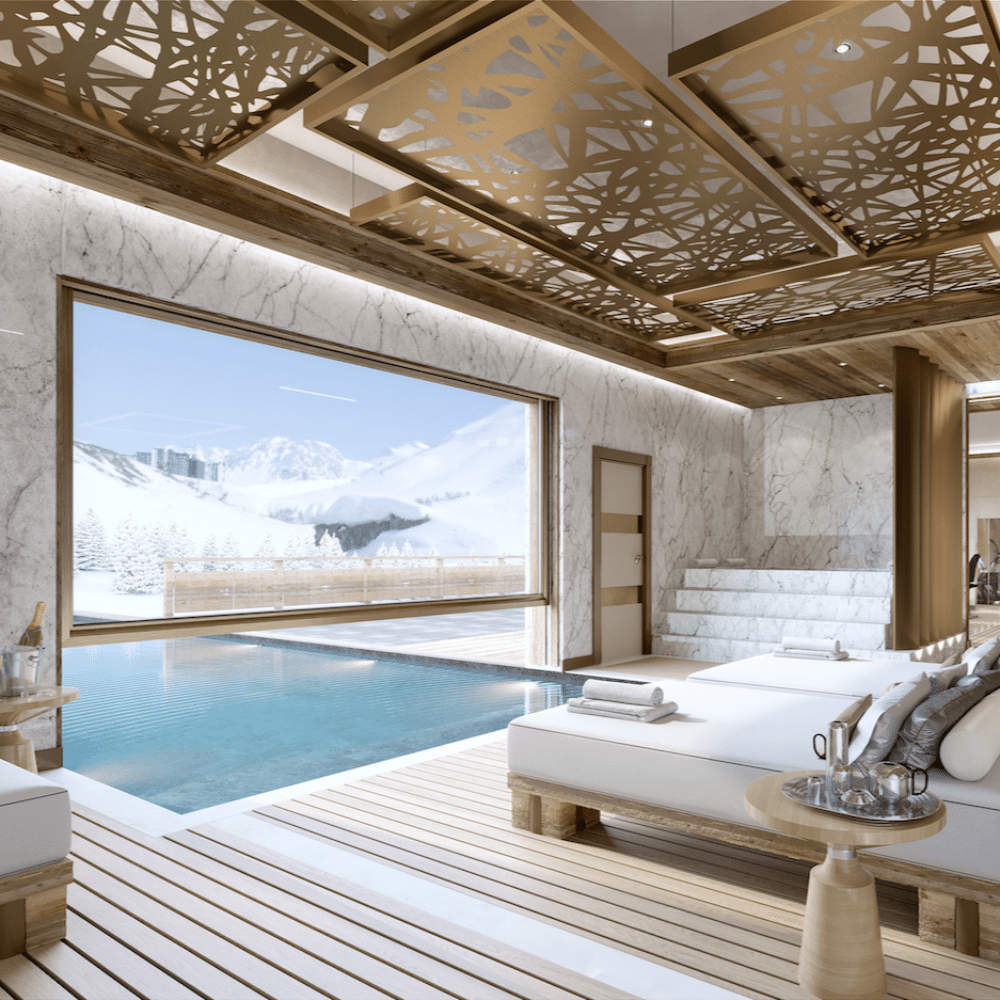

Featured Photo : © Moncler[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]At this complicated beginning of the year, many observations can be made regarding the financial strategies implemented by the luxury industry players. Companies are experiencing a slight economic recovery and are preparing to start the year 2021 in the best possible way, notably with mergers and acquisitions. Analysis.

The pandemic will have hit the luxury industry hard, particularly in the fashion and luxury goods sector. Few brands will continue to be independent apart from Chanel, Hermès and Rolex according to Erwan Rambourg, who wrote “Future luxury” and Managing Director and Global Head of Consumer and Retail Equity Research. Indeed, most of them will either go bankrupt, be acquired or merge with others.

As for the major brands that go bankrupt, they never disappear permanently, they convert or reappear under another name or new ownership. This is the case, for example, of Barneys which, after going bankrupt and being bought out by Authentic Brands, plans to open a unit in 2021 located in the New York flagship of Saks Fifth Avenue.

The last quarter of last year was also marked by three of the largest acquisitions, one of which was the largest transaction ever made in the luxury goods sector: in October, the acquisition of Tiffany and Co by LVMH for $15.8 billion. In November, VF Corporation, owner of Timberland, Vans and The North Face, purchased the Supreme streetwear brand for $2.1 billion. And finally, in early December, Moncler acquired the Stone Island men’s clothing brand for $1.4 billion.

[…][/vc_column_text][vc_cta h2=”This article is for subscribers only.” h2_font_container=”font_size:16″ h2_use_theme_fonts=”yes” h4=”Subscribe now!” h4_font_container=”font_size:32|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE!” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fabonnements-et-newsletter-2-2%2F|||”]Unlimited access to all the articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account? Log in.[/vc_cta][vc_column_text]Featured photo: © Moncler[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles”][vc_column][vc_column_text]At this complicated beginning of the year, many observations can be made regarding the financial strategies implemented by the luxury industry players. Companies are experiencing a slight economic recovery and are preparing to start the year 2021 in the best possible way, notably with mergers and acquisitions. Analysis.

The pandemic will have hit the luxury industry hard, particularly in the fashion and luxury goods sector. Few brands will continue to be independent apart from Chanel, Hermès and Rolex according to Erwan Rambourg, who wrote “Future luxury” and Managing Director and Global Head of Consumer and Retail Equity Research. Indeed, most of them will either go bankrupt, be acquired or merge with others.

As for the major brands that go bankrupt, they never disappear permanently, they convert or reappear under another name or new ownership. This is the case, for example, of Barneys which, after going bankrupt and being bought out by Authentic Brands, plans to open a unit in 2021 located in the New York flagship of Saks Fifth Avenue.

The last quarter of last year was also marked by three of the largest acquisitions, one of which was the largest transaction ever made in the luxury goods sector: in October, the acquisition of Tiffany and Co by LVMH for $15.8 billion. In November, VF Corporation, owner of Timberland, Vans and The North Face, purchased the Supreme streetwear brand for $2.1 billion. And finally, in early December, Moncler acquired the Stone Island men’s clothing brand for $1.4 billion.

[…][/vc_column_text][vc_cta h2=”This article is for subscribers only.” h2_font_container=”font_size:16″ h2_use_theme_fonts=”yes” h4=”Subscribe now!” h4_font_container=”font_size:32|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE!” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fabonnements-et-newsletter-2-2%2F|||”]Unlimited access to all the articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account? Log in.[/vc_cta][vc_column_text]Featured photo: © Moncler[/vc_column_text][/vc_column][/vc_row]