[vc_row njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

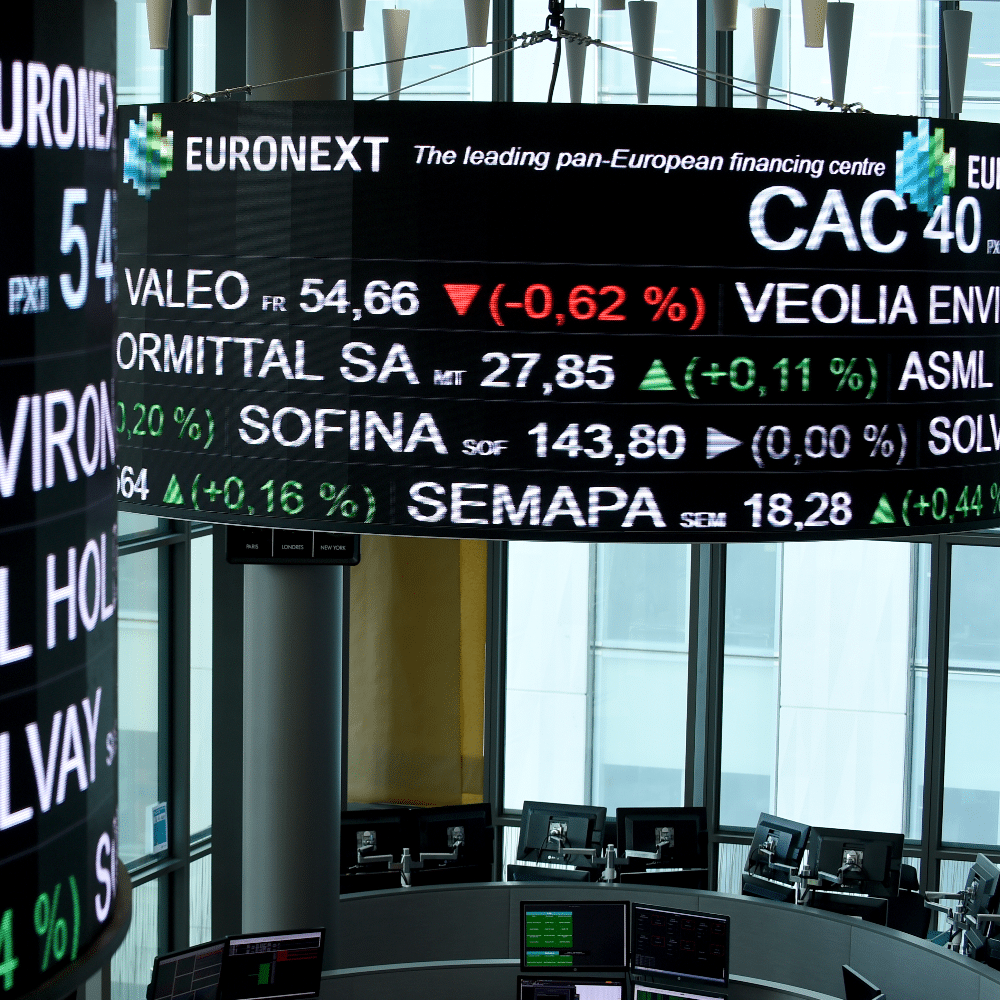

The CAC40 continued to rise at the opening on Monday morning to 6,069.09 points. With a 5th consecutive session of gains and 9 gains in the last 10 sessions, the Paris stock market seems to be stabilising above 6,000 points. UBS raised its earnings estimates for the luxury goods sector, which is expected to have a much stronger first quarter in 2021 than expected.

At midday, the CAC 40 has significantly reduced its gains but the likelihood of it posting a 6th consecutive session of gains tomorrow is well and truly present.

Supported by the prospect of a recovery in the US economy for some time now, notably thanks to the economic stimulus plan, the first $1,400 cheques sent out this weekend continue to fuel this optimism.

According to a Deutsche Bank survey, Americans would, on average, be prepared to invest 37% of the $1,400 stimulus package cheques, or more than $150 billion in total, in the stock market.

The US Federal Reserve’s monetary policy committee meets tomorrow and the day after. Analysts expect an upward revision of growth projections to be released on Wednesday.

However, the markets could well suffer from the health situation.

Indeed, even if the vaccination campaign has accelerated in the United States, the health crisis continues to deteriorate in Europe: Italy has decided to re-confine the whole country from today until the Easter weekend included; the Netherlands is considering suspending the use of AstraZeneca’s vaccine due to fears of possible side effects linked to this serum.

Luxury: First quarter 2021 significantly stronger than expected

On the luxury side, UBS expects the first quarter of 2021 to be significantly stronger than expected and believes that continued strong local consumer trends in the US and Europe and the Chinese New Year should lead to further acceleration in organic sales growth in the first quarter.

However, the research firm believes that this acceleration is not reflected in the consensus. For this reason, it expects the first quarter to be a positive catalyst for the luxury goods industry.

UBS expects average organic growth of 22%, compared to a consensus of 17%.

It should also be remembered that Burberry announced on Friday that it was experiencing a solid rebound in sales since December, which should enable it to post above-consensus annual results for the year ending 27 March.

The unexpected release sent the British luxury group’s stock soaring. On the London Stock Exchange, the share price rose 7.57% to 2,137 pence in early trading, the best performance on the pan-European STOXX 600 index.

At the end of the day in Paris, LVMH was down 1.38% at 555.50 euros, while Hermès and Kering were up 0.29% at 957 euros and 0.84% at 601.40 euros respectively.

Read also > PARIS STOCK EXCHANGE BACK IN THE GREEN AS THE CAC 40 ROSE OVER 6,000 POINTS

Featured Photo : © Press[/vc_column_text][/vc_column][/vc_row]