[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

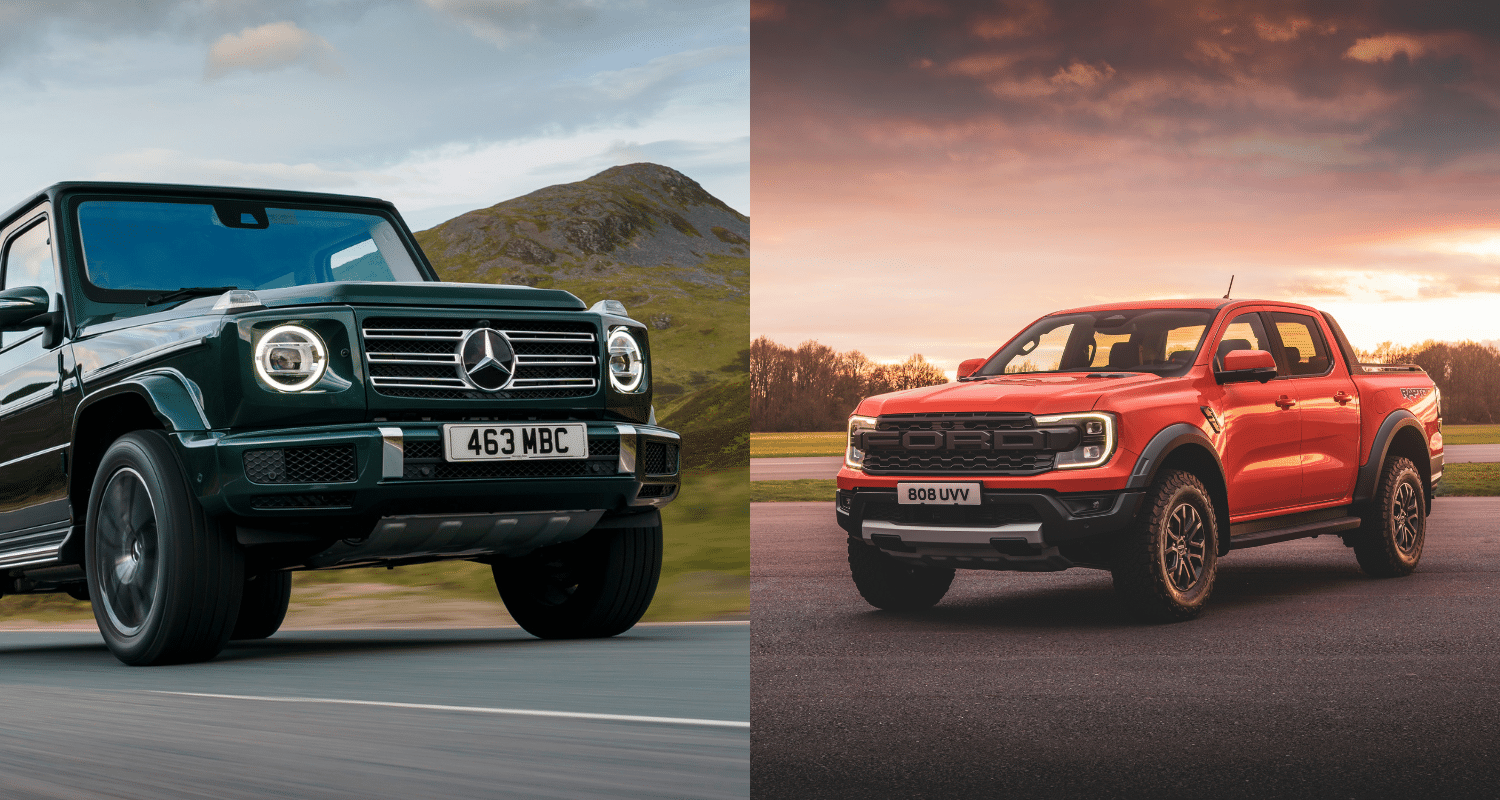

Automakers Mercedes-Benz and Ford have raised their forecasts for 2023, following the revelation of earnings well above expectations in the second quarter. The reasons? Rising orders and sales and an improved supply chain.

For automakers Mercedes Benz and Ford, second quarter earnings exceeded expectations. On the strength of these performances, both raised their forecasts for 2023.

Mercedes Benz

Prestigious car manufacturers such as Mercedes Benz, BMW or Porsche have been able to cope with rising costs in all areas, from raw materials to logistics. They were able to play on the exclusivity of their brands by passing on prices to their customers.

However, Mercedes has been cautious about the outlook, pointing to high interest rates that could dampen consumer spending.

Its EBITDA stood at 5 billion euros in the second quarter, more than analysts’ annual forecasts of 4.7 billion euros! In a statement issued on Thursday, the German company indicated that stocks were building up as a result of the deployment of its direct sales model and a ramp-up of its production.The manufacturer said it expected EBITDA to be around €20 billion for the whole year.

The forecast for its automotive division remained unchanged at stable revenues and an adjusted return on sales of 12-14%. But the manufacturer has raised its van division’s projected adjusted sales performance to 13-15% versus 11-13%, marking the second upgrade in less than three months after a significant increase in sales in the second quarter.

For the month of July, Mercedes Benz recorded a 6% growth in vehicle sales due to the strong demand for all-electric and premium cars, posting growth in Europe, Asia and North America.

Ford

For its part, the American automaker increased its adjusted profit forecast for the entire year to between $11 and $12 billion, compared to a forecast of $9 and $11 billion.

John Lawler, chief financial officer of Ford, said demand and vehicle prices were “holding up” better than the company had anticipated earlier this year for its traditional operations. However, “the adoption of electric vehicles is slower than expected by the company, partly due to higher costs“.

The Ford Blue business reported $2.3 billion during the quarter, while the Ford Pro business amounted to $2.39 billion. Its only Model e electric vehicle unit lost 1 billion from April to June.

The automaker reported a net profit of $1.92 billion, or 47 cents per share, up sharply from the previous year when it earned $667 million, or 16 cents per share.

Ford said its adjusted EBITDA jumped to $3.79 billion from $3.72 billion a year ago. On the other hand, its adjusted margin fell to 8.4%, from 9.3%, in a context of higher production and sales.

Total revenue for the quarter was $45 billion, up 12% from $40.2 billion the previous year.

Read also >Mercedes: sales increase in the first quarter of 2023

Featured photo : ©Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

Automakers Mercedes-Benz and Ford have raised their forecasts for 2023, following the revelation of earnings well above expectations in the second quarter. The reasons? Rising orders and sales and an improved supply chain.

For automakers Mercedes Benz and Ford, second quarter earnings exceeded expectations. On the strength of these performances, both raised their forecasts for 2023.

Mercedes Benz

Prestigious car manufacturers such as Mercedes Benz, BMW or Porsche have been able to cope with rising costs in all areas, from raw materials to logistics. They were able to play on the exclusivity of their brands by passing on prices to their customers.

However, Mercedes has been cautious about the outlook, pointing to high interest rates that could dampen consumer spending.

Its EBITDA stood at 5 billion euros in the second quarter, more than analysts’ annual forecasts of 4.7 billion euros! In a statement issued on Thursday, the German company indicated that stocks were building up as a result of the deployment of its direct sales model and a ramp-up of its production.The manufacturer said it expected EBITDA to be around €20 billion for the whole year.

The forecast for its automotive division remained unchanged at stable revenues and an adjusted return on sales of 12-14%. But the manufacturer has raised its van division’s projected adjusted sales performance to 13-15% versus 11-13%, marking the second upgrade in less than three months after a significant increase in sales in the second quarter.

For the month of July, Mercedes Benz recorded a 6% growth in vehicle sales due to the strong demand for all-electric and premium cars, posting growth in Europe, Asia and North America.

Ford

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

Automakers Mercedes-Benz and Ford have raised their forecasts for 2023, following the revelation of earnings well above expectations in the second quarter. The reasons? Rising orders and sales and an improved supply chain.

For automakers Mercedes Benz and Ford, second quarter earnings exceeded expectations. On the strength of these performances, both raised their forecasts for 2023.

Mercedes Benz

Prestigious car manufacturers such as Mercedes Benz, BMW or Porsche have been able to cope with rising costs in all areas, from raw materials to logistics. They were able to play on the exclusivity of their brands by passing on prices to their customers.

However, Mercedes has been cautious about the outlook, pointing to high interest rates that could dampen consumer spending.

Its EBITDA stood at 5 billion euros in the second quarter, more than analysts’ annual forecasts of 4.7 billion euros! In a statement issued on Thursday, the German company indicated that stocks were building up as a result of the deployment of its direct sales model and a ramp-up of its production.The manufacturer said it expected EBITDA to be around €20 billion for the whole year.

The forecast for its automotive division remained unchanged at stable revenues and an adjusted return on sales of 12-14%. But the manufacturer has raised its van division’s projected adjusted sales performance to 13-15% versus 11-13%, marking the second upgrade in less than three months after a significant increase in sales in the second quarter.

For the month of July, Mercedes Benz recorded a 6% growth in vehicle sales due to the strong demand for all-electric and premium cars, posting growth in Europe, Asia and North America.

Ford

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Press[/vc_column_text][/vc_column][/vc_row]