Concerns are dissipating on Wall Street this Monday morning, after the release of employment data in the United States, also reassuring the Asian stock markets.

The January U.S. payroll report reassured investors that annual growth in average hourly earnings rose to 5.7% from 4.9%, while the previous months’ payroll was revised up by 709,000 to dramatically change the hiring trend.

“The report not only indicated that payrolls were much higher than anyone could have imagined, but there was exceptional strength in earnings, which must be adding to a growing concern among Fed officials about upward pressure on inflation,” said Kevin Cummins, chief U.S. economist at NatWest Markets.

Last Friday, Mark Zuckerberg’s Meta suffered a catastrophic fall in the stock market, the biggest ever recorded for a U.S. company. As of Monday, the toll is clear : the Facebook owner has lost nearly $200 billion. BofA analyst Savita Subramanian noted that the company’s 2022 guidance had weakened significantly, with most shares falling on earnings reports.

“Comments suggest worsening labor shortages and supply chain issues, with a larger headwind expected in the first quarter than in the fourth,” Subramanian said in a note.

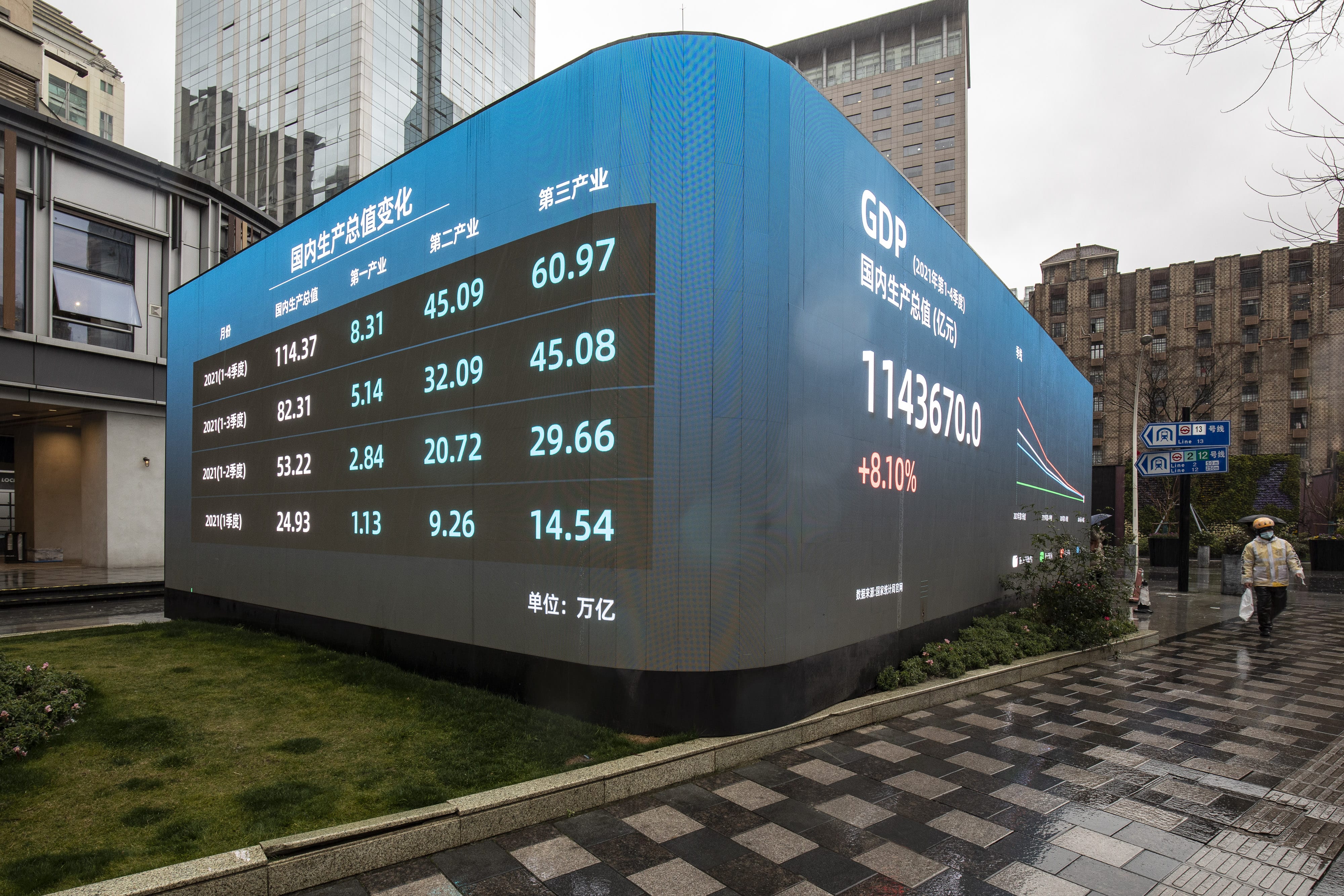

On the Asian side, MSCI‘s broadest index of Asia-Pacific stocks outside Japan plunged 0.3% on Monday. Japan’s Nikkei fell 0.8% and South Korea fell 0.4%. China returns after the Chinese New Year with jumps in stocks and commodities, with the blue-chip CSI300 and Shanghai Composite up 1.6% and 2%, respectively. Hong Kong’s Hang Seng, however, fell 0.4%.

In currencies, the euro retreated slightly from last week’s highs as markets advanced the likely timing of a first rate hike and sent bond yields sharply higher.

The dollar fared better against the Japanese yen as the market remains concerned about the Bank of Japan’s unlikely tightening during 2022. It was steady at 115.30 yen, while the euro was at 132.82 yen after climbing 2.7% last week.

Finally, gold was a bit firmer at $1,810 an ounce, but is struggling to cope with higher yields.

Read also > STOCK MARKET : PARIS LIFTED BY LUXURY GOODS BUT GLOBAL STOCKS AT JANUARY LOWS

Featured photo : © Getty Images