[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

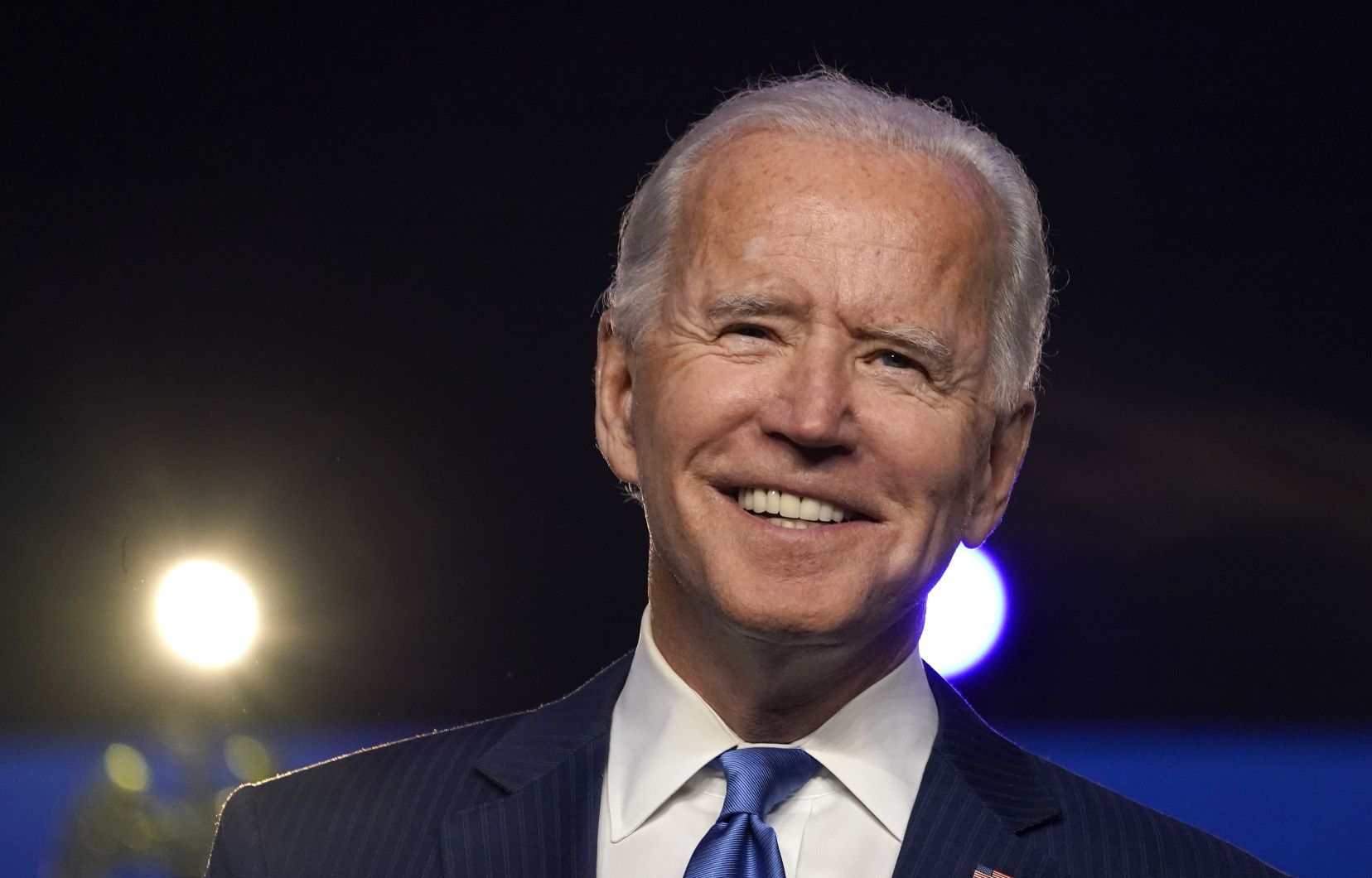

The recovery plan recently unveiled by the new American President is causing much controversy in the economic world. And for good reason: the additional stimulus of $1.9 trillion announced by Joe Biden followed the $900 billion plan to support the U.S. economy passed by Congress on December 21, 2020, and then enacted by the White House on December 27. So, what are the real consequences of this plan for the U.S. economy, but also for the world economy?

At first, Joe Biden’s recovery plan seemed to be blowing a slightly positive wind on the American and world markets. Indeed, the three main American indices have recently set new historical records, even if these results are not only due to the plan, but also to the acceleration of vaccination campaigns and central bank support.

On the other hand, this positive influence of the stimulus plan is very fragile and can very quickly reverse the situation. The further the threat of inflation looms over the US economy, the more it is perceived by investors. Investors remain on their guard as they await concrete signs of progress on the US stimulus front, which is expected to be voted on this month.

As a result, the Dow Jones gained 0.20% to 31,522.75 points on Tuesday but the Nasdaq fell for the first time in three sessions (-0.34%) and the S&P 500 lost 0.06%.

Indeed, some economists consider the amount disproportionate and forecast inflation that would be likely to lead to an upward spiral, which would push the U.S. Federal Reserve (Fed) to tighten its monetary policy and cause another economic crisis.

Economists such as Larry Summers and Olivier Blanchard fear a high level of additional household savings (estimated at around $1.6 trillion), a growing public deficit (close to 15% of GDP in 2020) and high growth expectations (+5.1% in 2021 according to the IMF).

However, the plan may be beneficial for the global economy, since it should not be overlooked that the Fed is aiming for more sustained inflation after several years below its 2% inflation target, which is now considered an average over time.

Another advantage of the stimulus is that an increase in government spending in the United States leads to an appreciation of the dollar and a deterioration in the trade balance. Given that the United States is seen as the consumer of last resort in the global economy, absorbing almost single-handedly the trade surpluses of the euro zone, China and Japan. The recovery could thus benefit the global economy via this leakage by US imports.

“It is necessary to strike hard“, insisted Joe Biden on Tuesday, estimating that his recovery plan would make it possible to create “7 million jobs this year“.

Case to follow.

Read also > JOE BIDEN AT THE WHITE HOUSE: HOW WILL THIS IMPACT THE EUROPEAN ECONOMY ?

Featured photo : © Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

The recovery plan recently unveiled by the new American President is causing much controversy in the economic world. And for good reason: the additional stimulus of $1.9 trillion announced by Joe Biden followed the $900 billion plan to support the U.S. economy passed by Congress on December 21, 2020, and then enacted by the White House on December 27. So, what are the real consequences of this plan for the U.S. economy, but also for the world economy?

At first, Joe Biden’s recovery plan seemed to be blowing a slightly positive wind on the American and world markets. Indeed, the three main American indices have recently set new historical records, even if these results are not only due to the plan, but also to the acceleration of vaccination campaigns and central bank support.

On the other hand, this positive influence of the stimulus plan is very fragile and can very quickly reverse the situation. The further the threat of inflation looms over the US economy, the more it is perceived by investors. Investors remain on their guard as they await concrete signs of progress on the US stimulus front, which is expected to be voted on this month.

As a result, the Dow Jones gained 0.20% to 31,522.75 points on Tuesday but the Nasdaq fell for the first time in three sessions (-0.34%) and the S&P 500 lost 0.06%.

[…][/vc_column_text][vc_cta h2=”Cet article est réservé aux abonnés.” h2_font_container=”font_size:16″ h2_use_theme_fonts=”yes” h4=”Abonnez-vous dès maintenant !” h4_font_container=”font_size:32|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”JE M’ABONNE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fabonnements-et-newsletter-2%2F|||”]Accédez en illimité à tous les articles et vivez une expérience de lecture inédite, contenus en avant première, newsletter exclusives…

Déjà un compte ? Connectez-vous.[/vc_cta][vc_column_text]Photo à la Une: © Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles”][vc_column][vc_column_text]

The recovery plan recently unveiled by the new American President is causing much controversy in the economic world. And for good reason: the additional stimulus of $1.9 trillion announced by Joe Biden followed the $900 billion plan to support the U.S. economy passed by Congress on December 21, 2020, and then enacted by the White House on December 27. So, what are the real consequences of this plan for the U.S. economy, but also for the world economy?

At first, Joe Biden’s recovery plan seemed to be blowing a slightly positive wind on the American and world markets. Indeed, the three main American indices have recently set new historical records, even if these results are not only due to the plan, but also to the acceleration of vaccination campaigns and central bank support.

On the other hand, this positive influence of the stimulus plan is very fragile and can very quickly reverse the situation. The further the threat of inflation looms over the US economy, the more it is perceived by investors. Investors remain on their guard as they await concrete signs of progress on the US stimulus front, which is expected to be voted on this month.

As a result, the Dow Jones gained 0.20% to 31,522.75 points on Tuesday but the Nasdaq fell for the first time in three sessions (-0.34%) and the S&P 500 lost 0.06%.

[…][/vc_column_text][vc_cta h2=”Cet article est réservé aux abonnés.” h2_font_container=”font_size:16″ h2_use_theme_fonts=”yes” h4=”Abonnez-vous dès maintenant !” h4_font_container=”font_size:32|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”JE M’ABONNE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fabonnements-et-newsletter-2-2%2F|||”]Accédez en illimité à tous les articles et vivez une expérience de lecture inédite, contenus en avant première, newsletter exclusives…

Déjà un compte ? <strong><a href=”https://test2023.luxus-plus.com/mon-compte/”>Connectez-vous</a>.</strong>[/vc_cta][vc_column_text]Photo à la Une: © Press[/vc_column_text][/vc_column][/vc_row]