[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

Containment measures and the physical closure of stores have demonstrated the strength of the marketplace model in the luxury industry. By offering five-star virtual showcases at a time when the luxury market is at a standstill, e-commerce platforms have indeed seen their sales climb since the beginning of the health crisis. This was the case for the British e-commerce giant in fashion and luxury goods, Farfetch, but also for Luxury Soho, Alibaba’s online outlet for luxury brands. The marketplace, the opportunity to capitalize on in the post-coronavirus era?

In the first quarter of 2020, while retail sales of luxury goods were being depleted by the global closures related to COVID-19, the Farfetch and Alibaba online sales platforms experienced a resurgence of activity, (very) satisfactory quarterly sales and smaller-than-expected losses.

Farfetch, luxury at your fingertips

The global technology platform of the luxury fashion industry announced in mid-May that its revenues increased 90 per cent over 2019 to $331 million in its four reporting segments, better than the expected loss of $313 million.

In addition, gross merchandise value (GVM) in the first quarter of 2020 increased 46% year-over-year to $494.9 million.

This is due to the digital revolution that Farfetch has been implementing for the past few years to preserve the entire luxury ecosystem, which has been accentuated in the context of the current situation: “This is an industry in urgent need of transformation. We had this vision for many years and this COVID-19 pandemic has accelerated it and put it at the top of the agenda for everyone. The industry needs to be reinvented and revolutionized” said Jose Neves, founder and CEO of Farfetch.

Farfetch therefore reaped the benefits of being exclusively an online retailer at a time when brands around the world were helplessly witnessing physical closures of their stores.

A move towards online shopping that the UK company was able to undertake a few years ago and now is more successful than ever: “The investments we have made to build the global platform for the luxury fashion industry have paid off, with features such as our global logistics capabilities, geographically diverse sourcing network and localised services for a global consumer base, enabling us to continue our operations and deliver our strong first quarter 2020 results.” said Jose Neves.

As a result, Farfetch has become the most visible online destination for 2.1 million customers in 190 countries, offering the fashion pieces of more than 3,500 luxury brands, including those of 500 leading luxury fashion houses such as Gucci, Prada, Valentino and Burberry, as well as nearly 3,000 small independent designers.

A “business to consumer” model that has benefited the platform itself, as it increases its market share, but also consumers who can purchase their favorite piece from home, and especially luxury brands that thereby support their own digital operations.

In the end, Farfetch defends the relevance of its business model in the future, convinced that the world will not return to the same “normal” as it was before Covid-19 and that it will therefore be necessary to revolutionize the luxury market: “As we consider the structural changes that are likely to impact the luxury industry, I am convinced that our unique set of capabilities positions Farfetch to be even stronger in the future“, concludes CEO Jose Neves.

Alibaba’s “Luxury Soho”, the revenge shopping frenzy

The Alibaba Group, for its part, announced on Friday May 22nd a solid growth of its revenues and a new milestone of US$1 trillion in gross traded volume of goods in the Alibaba digital economy for its first quarter 2020.

Its e-commerce site Tmall has seen a growing trend towards revenge buying in recent months as Chinese consumers have been spending frenetically to make up for lost time due to the lockdown.

But most importantly, the digital platform saw record participation from luxury brands for its sales campaign on May 20 for “5.20” (date format in China), an unofficial romantic holiday celebrating lovers.

More than 150 luxury brands launched 5,000 new products and brands such as Cartier, Longines, Chanel, Yves Saint Laurent Beauty and Tom Ford launched special edition gift boxes for the event. Tmall’s luxury division said consumers placed more than 400,000 orders for luxury products that day, while total luxury spending increased 61% over 2019 in the same period.

French luxury fashion house Chloé even released its first official livestream, attracting more than 62,000 curious viewers, while Balenciaga raked in 38,000 new followers shortly after opening its flagship store on Tmall’s Luxury Pavilion.

This growth is a real phenomenon and is explained by the fact that the Chinese are likely to travel less this year and therefore spend less in luxury boutiques around the world, but they will consume the same products online.

This trend could be comparable to the “revenge spending” seen in China in the 1990s, when the country emerged from isolation and experienced very sustained growth. This phenomenon was also observed in Japan after the 2011 tsunami.

According to experts, in the face of uncertainty, some people choose to live each moment to the fullest, taking up the famous “carpe diem“, or motto: “live happily today, tomorrow it will be too late“.

Digital platforms therefore have a significant role to play in the luxury industry, not only because they can demonstrate their resilience in times of crisis, but also for their ability to adapt to an ever-changing environment and to serve the designers and consumers community, bringing the convenience of online luxury shopping to future customers around the world.

The Bain consulting firm expects the share of online commerce to reach 30% by 2025 and that the penetration of online commerce will be increasingly significant in the luxury industry.

Read also > Second-hand online sales: luxury products increasingly attractive throughout crisis period

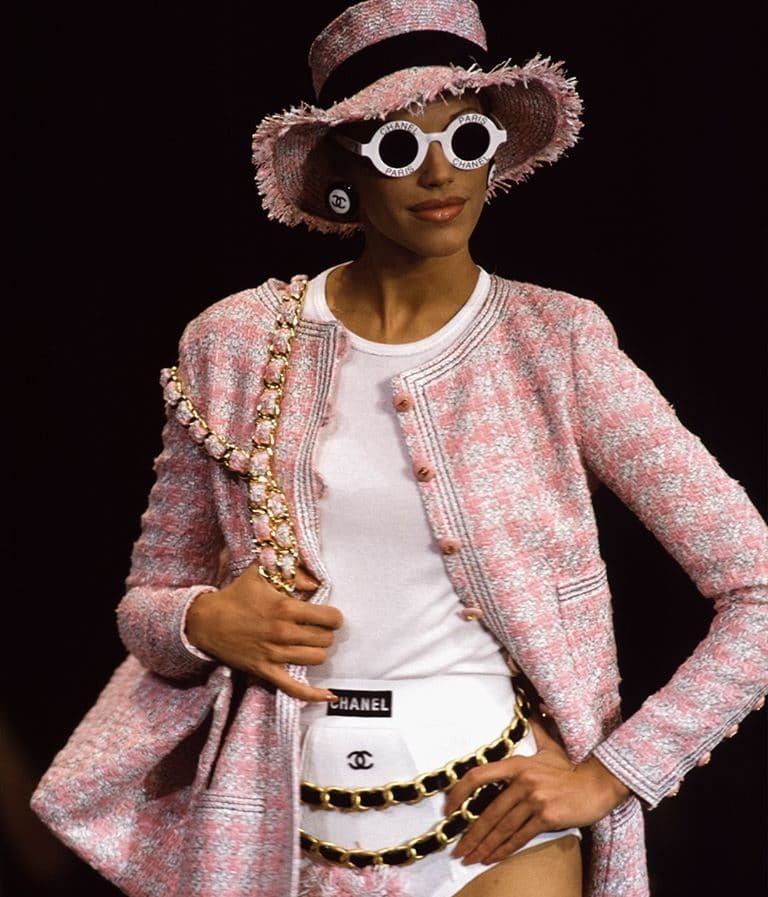

Featured photo : © Farfetch

[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

Containment measures and the physical closure of stores have demonstrated the strength of the marketplace model in the luxury industry. By offering five-star virtual showcases at a time when the luxury market is at a standstill, e-commerce platforms have indeed seen their sales climb since the beginning of the health crisis. This was the case for the British e-commerce giant in fashion and luxury goods, Farfetch, but also for Luxury Soho, Alibaba’s online outlet for luxury brands. The marketplace, the opportunity to capitalize on in the post-coronavirus era?

In the first quarter of 2020, while retail sales of luxury goods were being depleted by the global closures related to COVID-19, the Farfetch and Alibaba online sales platforms experienced a resurgence of activity, (very) satisfactory quarterly sales and smaller-than-expected losses.[/vc_column_text][vc_cta h2=”This article is for subscribers only.” h2_font_container=”font_size:16″ h2_use_theme_fonts=”yes” h4=”Subscribe now!” h4_font_container=”font_size:32|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE!” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fabonnements-et-newsletter-2%2F|||”]Unlimited access to all the articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account? Log in.

[/vc_cta][vc_column_text]Featured photo : © Farfetch[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”customer”][vc_column][vc_column_text]

Containment measures and the physical closure of stores have demonstrated the strength of the marketplace model in the luxury industry. By offering five-star virtual showcases at a time when the luxury market is at a standstill, e-commerce platforms have indeed seen their sales climb since the beginning of the health crisis. This was the case for the British e-commerce giant in fashion and luxury goods, Farfetch, but also for Luxury Soho, Alibaba’s online outlet for luxury brands. The marketplace, the opportunity to capitalize on in the post-coronavirus era?

In the first quarter of 2020, while retail sales of luxury goods were being depleted by the global closures related to COVID-19, the Farfetch and Alibaba online sales platforms experienced a resurgence of activity, (very) satisfactory quarterly sales and smaller-than-expected losses.[/vc_column_text][vc_cta h2=”This article is for subscribers only.” h2_font_container=”font_size:16″ h2_use_theme_fonts=”yes” h4=”Subscribe now!” h4_font_container=”font_size:32|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE!” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fabonnements-et-newsletter-2%2F|||”]Unlimited access to all the articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account? Log in.

[/vc_cta][vc_column_text]Featured photo : © Farfetch[/vc_column_text][/vc_column][/vc_row]