[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

Several areas of the economy are impacted by the consequences of the coronavirus. Most affected are the tourism and luxury goods sectors, with €40 billion in sales losses estimated by industry leaders as a result of the epidemic. The luxury industry will therefore record its lowest performance since 2015.

Economically, the coronavirus has caused many losses in record time. Like many other sectors, the luxury goods sector, which accounts for $320 billion worldwide, is beset by uncertainty about the duration of the effects of the coronavirus.

In mid-February, the CEO of the Kering group (Gucci, Saint-Laurent…), François-Henri Pinault, was already noting a 15% drop in sales in the first quarter. It should also be noted that the Chinese represent 2.5% of the country’s visitors. And they spend nearly 4 billion euros in luxury goods.

Another problem, and not the least important one, is the supply of clothing itself. While for luxury brands, most production is carried out in Europe, for premium, medium and fast fashion ready-to-wear labels, China is often a major production area.

And as the virus spreads across the country, industrial activity is taking quite a hit.

According to the Observatory of the French Fashion Institute, China and Hong Kong account for 27% of the supply of French brands. This is cause for concern for French manufacturers, who will have to anticipate numerous delivery delays and will probably have difficulty installing their new collections in stores when the crisis ends.

In France, an entire ecosystem is paralyzed

With the move to Stage 3 in France, the outlook has become even more bleak. The forecasts of the most pessimistic analysts had previously estimated the decline in the luxury market at 20%. Goldman Sachs even expects a 30% drop in sales in the sector in the first quarter and a 24% drop over the year 2020.

“We are worried because there is no visibility on the activity in April and May” says Marc Pradal, co-president of the French Union of Fashion and Clothing Industries (Union française des industries mode et habillement).

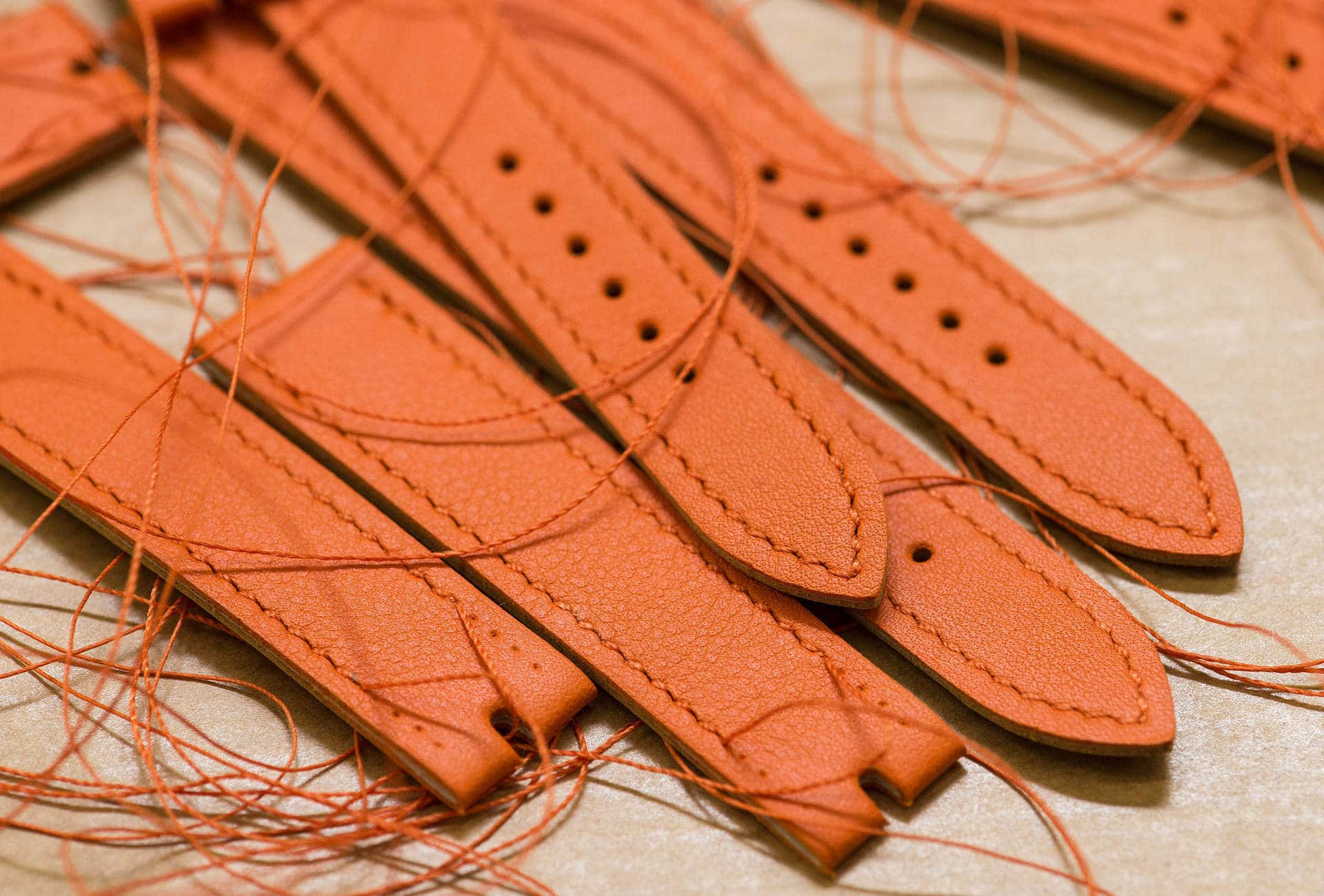

For its part, Hermès announced the closure of 40 sites in France. The decision concerns both the leather goods workshops and the saddler’s tanneries.

Independent production facilities are also at the forefront. Some companies have cancelled orders, but compensated SMEs to safeguard know-how, pending the restart.

The fashion shows were also cancelled due to the coronavirus pandemic, as the Federation of Haute-Couture and Fashion considered that “the conditions are not in place to allow events to unfold” in the face of “the progress of the Covid-19 epidemic which is spreading throughout the world“. “Three seasons are now threatened, those in progress in the shops, the orders expected in April after Paris Fashion Week, and the pre-collections usually presented to buyers in May,” says Pierre-François le Louet, president of the Women’s Ready-to-Wear Federation.

Containment has led to the closure of non-essential shops and with it of course the closure of women’s ready-to-wear signs. This has led to tensions between suppliers, service providers, brands, retailers and chains. The cash flow of VSE-SMEs is much smaller than that of large chains and large groups. Their difficulties are therefore major. In France, the Women’s Ready-to-Wear Federation has therefore set up a crisis unit headed by Adeline Dargent, General Delegate of the Paris Women’s Fashion Union, to help the players in the most difficult negotiations and to share best practices. This cell can be reached at the union’s telephone number. The main difficulty that comes up to the crisis unit consists in tensions with international subcontractors (manufacturers, distributors and brands). But unlike the 2008 crisis, the dialogue between principals and subcontractors is less tense: without discussion, compensation was offered, up to 70%, to compensate for lost orders.

Read also > Coronavirus : Kering warns of 13% to 14% revenue drop in first quarter[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

Several areas of the economy are impacted by the consequences of the coronavirus. Most affected are the tourism and luxury goods sectors, with €40 billion in sales losses estimated by industry leaders as a result of the epidemic. The luxury industry will therefore record its lowest performance since 2015.

Economically, the coronavirus has caused many losses in record time. Like many other sectors, the luxury goods sector, which accounts for $320 billion worldwide, is beset by uncertainty about the duration of the effects of the coronavirus.

In mid-February, the CEO of the Kering group (Gucci, Saint-Laurent…), François-Henri Pinault, was already noting a 15% drop in sales in the first quarter. It should also be noted that the Chinese represent 2.5% of the country’s visitors. And they spend nearly 4 billion euros in luxury goods.

This article is reserved for subscribers.

Subscribe now!

Unlimited access to all the articles and live an original reading experience, preview content, exclusive newsletters …

[/vc_column_text][vc_btn title=”I suscribe!” color=”black” size=”lg” align=”center” link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fabonnements-et-newsletter-2%2F|||”][vc_column_text]

Already have an account? Log in.

[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”customer”][vc_column][vc_column_text]

Several areas of the economy are impacted by the consequences of the coronavirus. Most affected are the tourism and luxury goods sectors, with €40 billion in sales losses estimated by industry leaders as a result of the epidemic. The luxury industry will therefore record its lowest performance since 2015.

Economically, the coronavirus has caused many losses in record time. Like many other sectors, the luxury goods sector, which accounts for $320 billion worldwide, is beset by uncertainty about the duration of the effects of the coronavirus.

In mid-February, the CEO of the Kering group (Gucci, Saint-Laurent…), François-Henri Pinault, was already noting a 15% drop in sales in the first quarter. It should also be noted that the Chinese represent 2.5% of the country’s visitors. And they spend nearly 4 billion euros in luxury goods.

This article is reserved for subscribers.

Subscribe now!

Unlimited access to all the articles and live an original reading experience, preview content, exclusive newsletters …

[/vc_column_text][vc_btn title=”I suscribe!” color=”black” size=”lg” align=”center” link=”url:https%3A%2F%2Ftest2023.luxus-plus.com%2Fen%2Fabonnements-et-newsletter-2%2F|||”][vc_column_text]

Already have an account? Log in.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row]