[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

On the occasion of the publication of its half-yearly results, the luxury group Kering announced that it had taken a 30% stake in Valentino, for an amount of 1.7 billion euros.

After the Creed Perfume House, the Valentino House. Indeed, it seems that the French luxury group Kering is on a roll. A few weeks after announcing the acquisition of perfumer Creed, Kering unveils its stake in Valentino, for an amount of 1.7 billion euros.

Kering et Mayhoola annoncent avoir signé un accord engageant pour l’acquisition par Kering d’une participation de 30% dans Valentino dans le cadre d’un partenariat stratégique.https://t.co/LYxNJVEfhu pic.twitter.com/59odrhqfvn

— Kering (@KeringGroup) July 27, 2023

This agreement includes an option that would allow Kering to “acquire 100% of the fashion house by 2028 at the latest” says the brand owner, Mayhoola ( editor’s note: Qatari investment fund, owner of luxury houses like Balmain and Missoni).

As part of this strategic partnership, the Kering and Mayhoola groups say they will look at potential opportunities, in line with their respective development strategies.

This merger should allow Valentino to strengthen its branding strategy, while it will allow Kering to become “a reference shareholder represented on Valentino’s board of directors“.

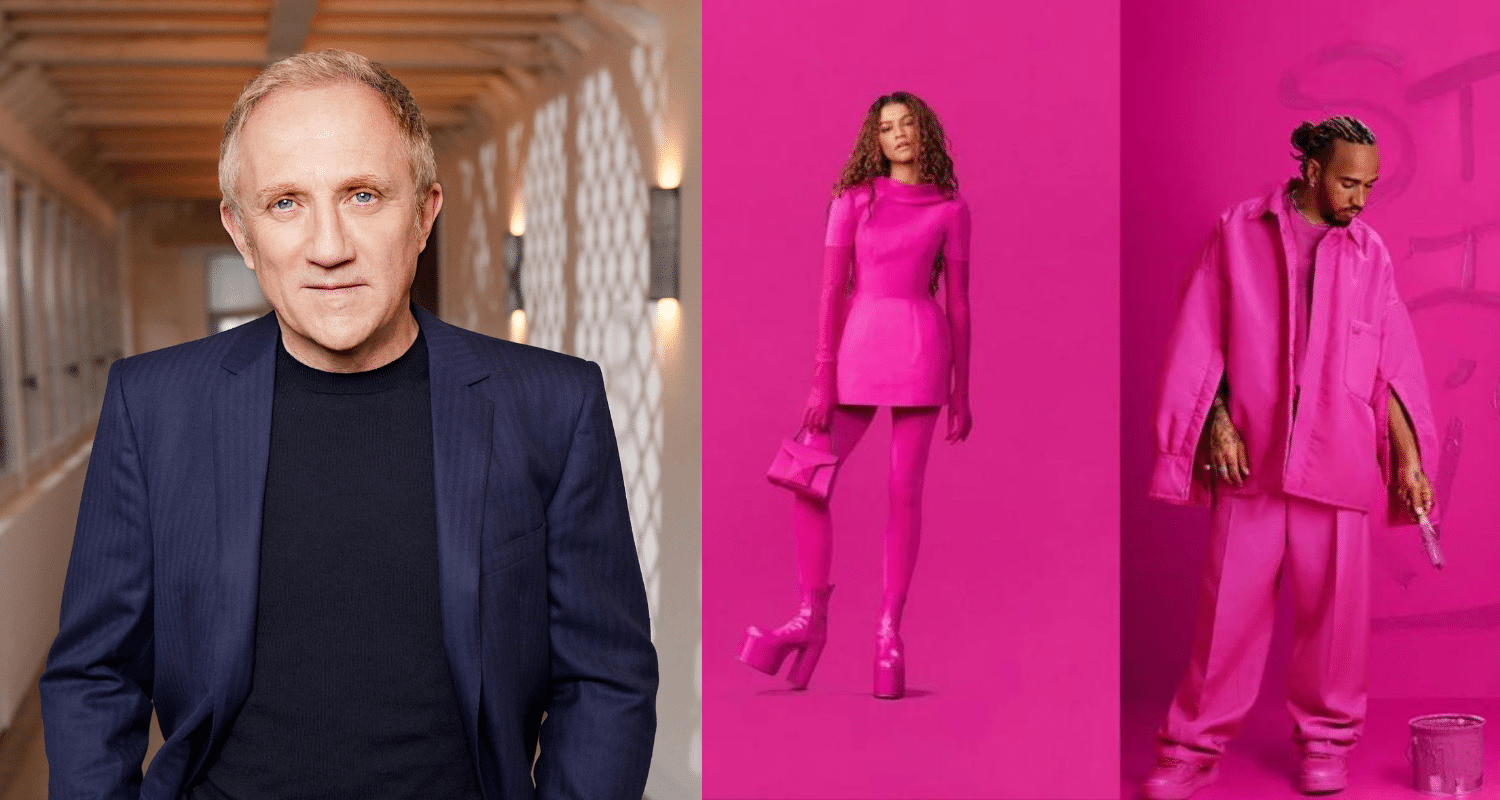

“I am impressed by the evolution of Valentino under the control of Mayhoola and very happy that Mayhoola chose Kering as a partner for the development of Valentino, a unique Italian house synonymous with beauty and elegance,” comments François-Henri Pinault, CEO of Kering.

An important complementarity

During the presentation of the group’s results, the leader stressed how “Valentino’s potential is very important and significant for the years to come. The brand is very complementary to the rest of our portfolio and our Italian brands“.

According to Luca Solca, an analyst at Bernstein who specializes in luxury “Valentino could be considered the Italian equivalent of Saint Laurent: a company with which Kering has created value“.

“Valentino is a haute couture house positioned on a very high-end and sophisticated aesthetic segment. Through the discussions we have had with managers and shareholders, we know where it can progress in the future,” continues François Henri-Pinault.

It corresponds “typically to the brands we are looking for, meeting the criteria, which we have always cited in our merger and acquisition strategy“, he adds, recalling that Kering knows the brand’s CEO well, Jacopo Venturini, who worked in the past for Gucci, the flagship house of the French luxury group.

“Of course we will play with synergies. It could be in real estate, logistics, human resources, etc. The group will support Valentino. The discussions we had with Mayhoola and management convinced us about what we can bring to Valentino in the coming years, not only by managing to continue developing the brand, but also to significantly strengthen its profitability“.

In parallel, the French luxury group published its semi-annual results. Net income share reached €1.785 billion, up from almost €2 billion a year earlier.

It also generated recurring operating income, down 3% ($2.74 billion). That of its main brand, Gucci, fell by 4% ( 1.8 billion) while that of Yves Saint Laurent rose by 10% ( 481 million). Revenue reached €10 billion, up 2% both on a public and a comparable basis.

The completion of the transaction between Kering and the fashion house is expected by the end of the year. Mayhoola will remain Valentino’s majority shareholder with 70% of the capital.

Read also >Kering strengthens its beauty division with Creed fragrances

Featured photo : ©Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

On the occasion of the publication of its half-yearly results, the luxury group Kering announced that it had taken a 30% stake in Valentino, for an amount of 1.7 billion euros.

After the Creed Perfume House, the Valentino House. Indeed, it seems that the French luxury group Kering is on a roll. A few weeks after announcing the acquisition of perfumer Creed, Kering unveils its stake in Valentino, for an amount of 1.7 billion euros.

Kering et Mayhoola annoncent avoir signé un accord engageant pour l’acquisition par Kering d’une participation de 30% dans Valentino dans le cadre d’un partenariat stratégique.https://t.co/LYxNJVEfhu pic.twitter.com/59odrhqfvn

— Kering (@KeringGroup) July 27, 2023

This agreement includes an option that would allow Kering to “acquire 100% of the fashion house by 2028 at the latest” says the brand owner, Mayhoola ( editor’s note: Qatari investment fund, owner of luxury houses like Balmain and Missoni).

As part of this strategic partnership, the Kering and Mayhoola groups say they will look at potential opportunities, in line with their respective development strategies.

This merger should allow Valentino to strengthen its branding strategy, while it will allow Kering to become “a reference shareholder represented on Valentino’s board of directors“.

“I am impressed by the evolution of Valentino under the control of Mayhoola and very happy that Mayhoola chose Kering as a partner for the development of Valentino, a unique Italian house synonymous with beauty and elegance,” comments François-Henri Pinault, CEO of Kering.

An important complementarity

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

On the occasion of the publication of its half-yearly results, the luxury group Kering announced that it had taken a 30% stake in Valentino, for an amount of 1.7 billion euros.

After the Creed Perfume House, the Valentino House. Indeed, it seems that the French luxury group Kering is on a roll. A few weeks after announcing the acquisition of perfumer Creed, Kering unveils its stake in Valentino, for an amount of 1.7 billion euros.

Kering et Mayhoola annoncent avoir signé un accord engageant pour l’acquisition par Kering d’une participation de 30% dans Valentino dans le cadre d’un partenariat stratégique.https://t.co/LYxNJVEfhu pic.twitter.com/59odrhqfvn

— Kering (@KeringGroup) July 27, 2023

This agreement includes an option that would allow Kering to “acquire 100% of the fashion house by 2028 at the latest” says the brand owner, Mayhoola ( editor’s note: Qatari investment fund, owner of luxury houses like Balmain and Missoni).

As part of this strategic partnership, the Kering and Mayhoola groups say they will look at potential opportunities, in line with their respective development strategies.

This merger should allow Valentino to strengthen its branding strategy, while it will allow Kering to become “a reference shareholder represented on Valentino’s board of directors“.

“I am impressed by the evolution of Valentino under the control of Mayhoola and very happy that Mayhoola chose Kering as a partner for the development of Valentino, a unique Italian house synonymous with beauty and elegance,” comments François-Henri Pinault, CEO of Kering.

An important complementarity

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Press[/vc_column_text][/vc_column][/vc_row]